Dallas Fed President Robert Kaplan and Boston Fed President Eric Rosengren both announced on Monday, Sept. 27, that they were retiring from their posts, in the wake of a Wall Street Journal exposé of the fact that they had each engaged in substantial personal financial market transaction which stood to benefit by the Fed’s QE activities. Kaplan reportedly traded millions of dollars in stocks last year; Rosengren likewise traded stocks and also moved into funds that were buying mortgage-backed bonds – which the Fed’s QE policy directly supports. Norman Eisen, senior fellow at the Brookings Institution and expert on “government ethics,” said: “The idea that these senior Fed officials are actively trading is insane, given the power and information and the responsibility that they have.”

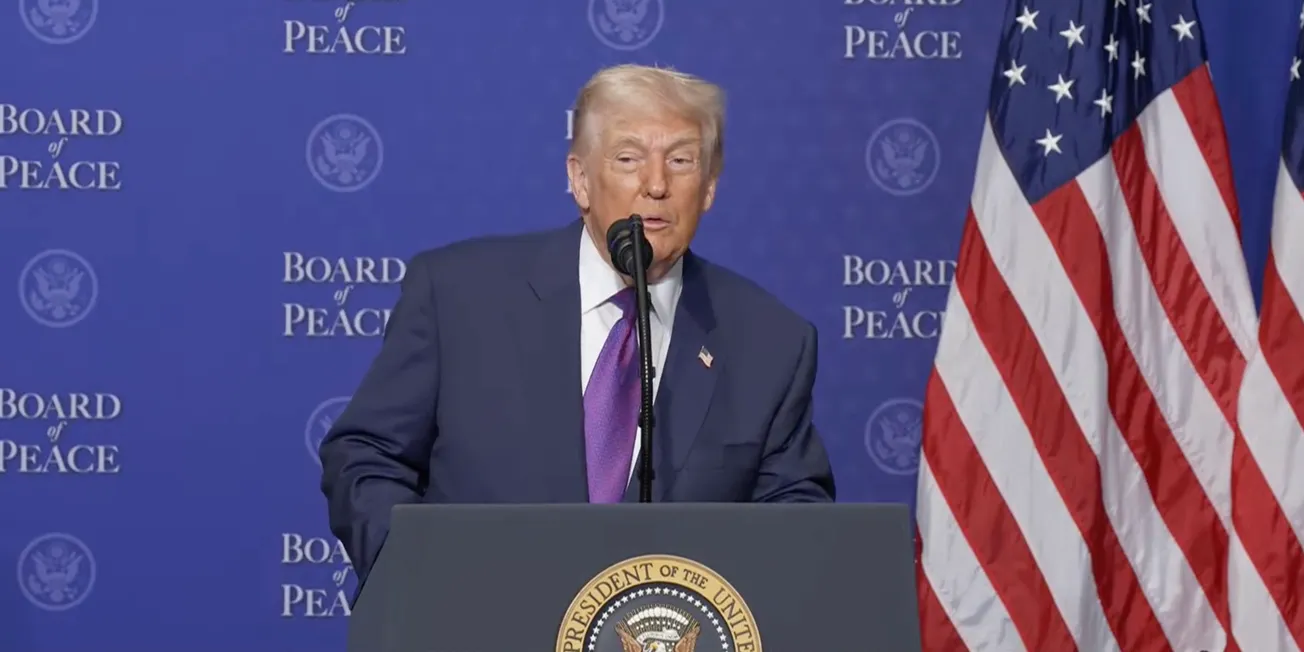

Fed chairman Jerome Powell was more forgiving in his testimony yesterday before the Senate Banking Committee. Powell said that Kaplan and Rosengren’s actions were within Fed ethics guidelines, but admitted that those guidelines might have to be tightened a tad. “The appearance is just obviously unacceptable,” Powell said. “Our need to sustain the public’s trust is the essence of our work.”

Also on Powell’s mind is the fact that last week he himself came under scrutiny over Fed purchases of municipal bonds, in which he and his wife have a very large portfolio.