Today’s Financial Times reports that “China’s top lenders—Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China and Bank of China—have all reported there was no direct damage to their books from last month’s emergency rescue of Credit Suisse by UBS and failures in the U.S. banking sector. ‘Even from an indirect or spillover effect perspective, the impact [to China’s banking sector] is very limited,’ said Ji Zhihong, vice-president of the country’s second-largest bank CCB [China Construction Bank] at a briefing last week, when all the main banks reported strong earnings.”

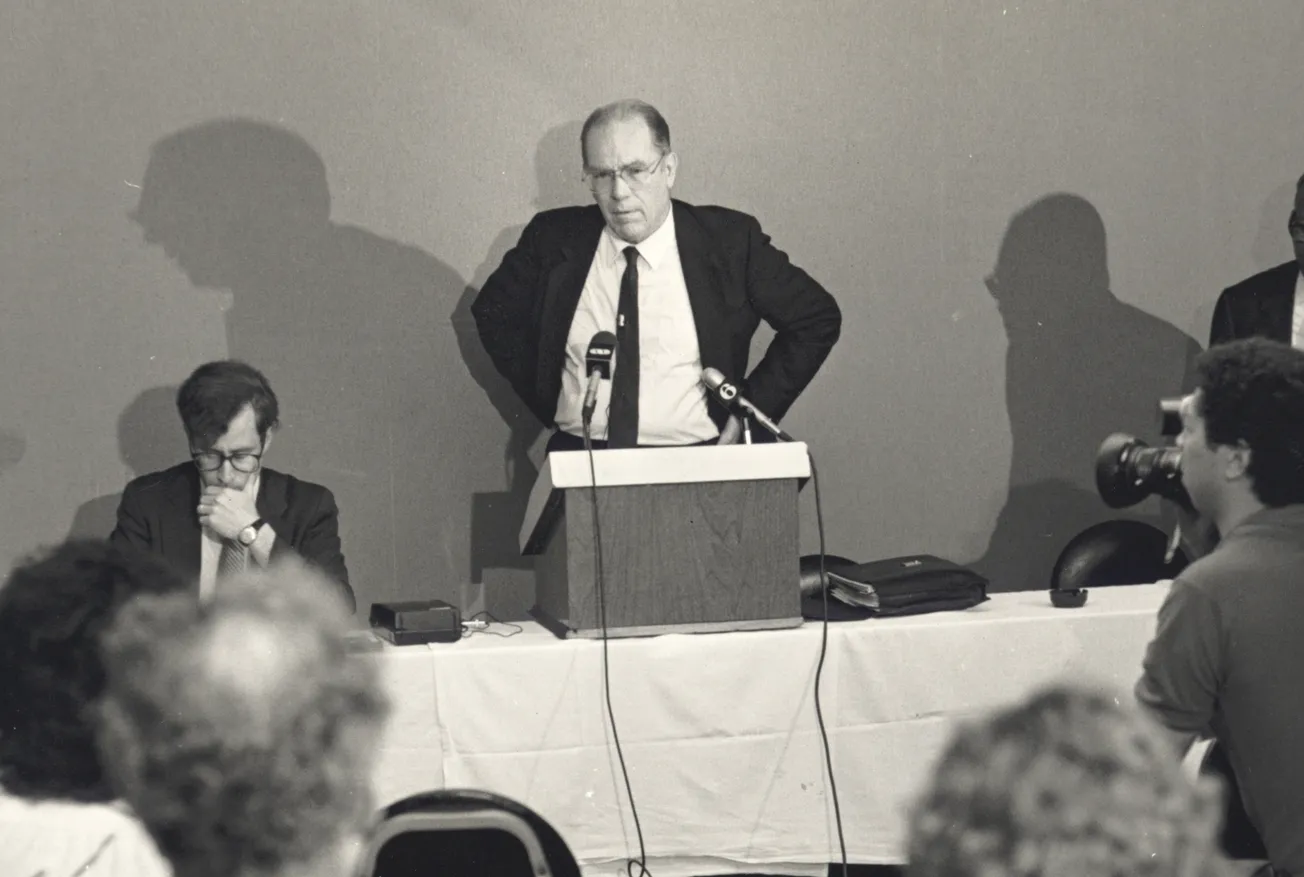

Chen Long, co-founder of Beijing-based research company Plenum, was critical of the policies adopted by the U.S. Fed and other Western central banks: “The radical change of monetary policy is a very bad idea. If you have to raise interest rates by 300 [basis points] in a year, that is definitely going to cause a lot of strain on the banking system.” With studied understatement he continued: “The framework of regulating banks globally now looks insufficient at least. The irony is that the Swiss are viewed as leaders in how to regulate banks. Then Credit Suisse, the [country’s] second-largest bank failed,” he declared.