There is widespread international recognition that we are witnessing the demise of the global floating-exchange-rate financial system established a half-century ago, after Aug. 15, 1971—a system which has disgorged a $2 quadrillion speculative bubble, side-by-side with cruel looting of the physical economy of the so-called North, but especially of the Global South. It is also evident that a new system is arising, with intense discussion in the Global South about how to set up a de-dollarized system, for example around an expanded “BRICS Plus” association of nations; while the subject of a return to Glass-Steagall in the United States and Europe is back on the agenda—as we document in the chronologies below.

The upcoming August 22-24 summit of the BRICS nations in Johannesburg, South Africa could well be a decisive inflection point.

But there is also widespread confusion over some physical-economic essentials, long elaborated by Lyndon LaRouche, without which the transition to a new international system will be chaotic at best, and can unleash nuclear World War III at worst. The essentials are summarized in LaRouche’s “Four Laws” and his “Trade Without Currency,” among other locations.

Stated simply: It is necessary, but not even close to sufficient, to abandon the sinking financial Titanic. The central questions that such first, required action poses are: What kind of life boats will replace the Titanic? How are they constructed, and what ultimately keeps them afloat? And where are they sailing?

There are three, central criteria that the new system and its currency must meet:

1. Total separation between the new currency and participating national currencies, on the one side, and the predatory, toxic dollar on the other, i.e., no free convertibility between them. Exchange and capital controls become essential tools to achieve that result. For the United States, this means a return to Glass-Steagall, with its strict separation between productive credit and speculative activity.

2. A fixed exchange-rate relationship between and among those participating national currencies and the new currency. Floating exchange rates have been a tool of financial speculation since August 1971, and they are anathema to long-term trade and investment cooperation among sovereign nations.

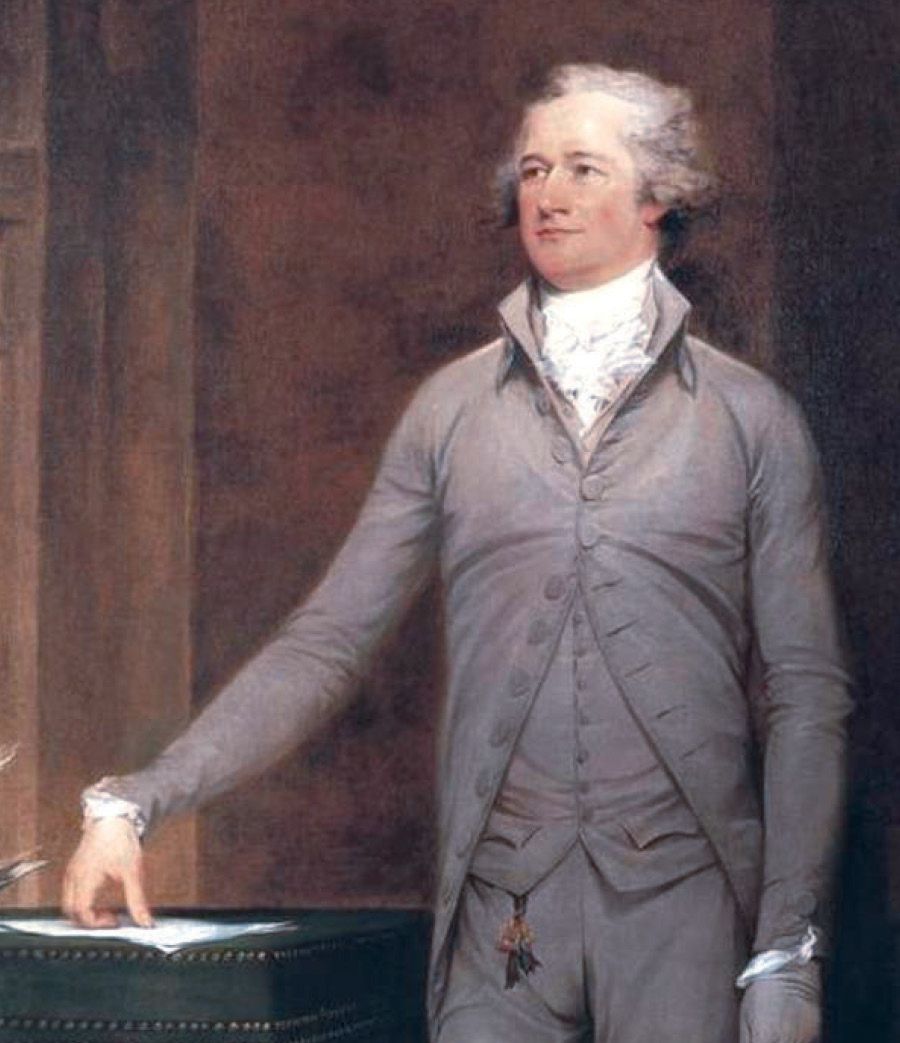

3. Productive credit must be issued in that new currency to finance great development projects, with a heavy emphasis on science and advanced technologies, in and among participating nations, to quickly boost the physical economies and thereby provide the only possible solid backing for the value and stability of the new currency. Think Alexander Hamilton.

Back to FDR’s Glass-Steagall

A useful entry point for the discussion and elaboration of these three criteria is to recognize that a return to Franklin Roosevelt’s 1933 Glass-Steagall Act in the United States, or bank separation as it is known in Europe, is essentially the same policy as the Global South’s current drive for “de-dollarization.” They are both ways of jumping off the sinking Titanic. In both cases, the speculative, London-based dollar is abandoned and walled off, while each nation’s national banking system is rebuilt on non-speculative assets, and on investment in non-speculative productive activity, thereby de facto creating a new currency. In the case of the United States, this “new currency” would take the form of a return to the productive U.S. dollar—or Lincoln’s greenback—as distinct from the speculative London-dollar, or “Londollar,” which rules the trans-Atlantic financial sector today.

Such an approach, and only such an approach, opens the door to a working alliance between the Global South and a United States rid of the domination by Wall Street and City of London interests. This is the United States of George Washington, John Quincy Adams, Abraham Lincoln, Franklin Delano Roosevelt, and Lyndon LaRouche. Such a working alliance is the only sure basis for war avoidance and universal development.

With those concepts and criteria in mind, consider this summary overview of the highlights of recent discussion and actions worldwide around Glass-Steagall and de-dollarization.

Sanctions Provoke De-Dollarization

Immediately after President Vladimir Putin announced Russia’s Special Military Operation (SMO) of Feb. 24, 2022, Western sanctions against Russia were ratcheted sharply up: Some $300 billion of Russia’s foreign reserves, the part held abroad, was summarily seized; trade was blocked; and London and Washington endeavored to force Russia to default on its debt obligations. The “ruin” of Russia was declared the strategic objective.

It should be emphasized that the sanctions regimen against Russia (and other countries) was in force long before Feb. 24, 2022—as we document in the chronology below. In fact, as far back as July 31, 2014 the Council of the European Union had adopted Council Decision 2014/512/CFSP, which called on member nations to “prohibit transactions in or the provision of financing or investment services … issued by state-owned Russian financial institutions.” The resolution also prohibited “the sale, supply, transfer or export of certain sensitive goods and technologies” to Russia.

Just as Russia’s SMO was not “unprovoked military aggression,” but rather the result of 30 years of NATO expansion eastward (violating explicit official promises given to the Soviet Union and Russia), which dramatically escalated after the 2014 coup d’état against the democratically elected Yanukovych government of Ukraine; so too the Global South’s steps toward de-dollarization are also not a matter of “unprovoked economic aggression” against the United States and its currency. Rather, they are survival measures adopted in defense against economic and financial warfare, responding to explicit statements by U.S. and other officials that their goal is to “reduce the ruble to rubble” and make sure the Russian economy is “cut in half” (President Joe Biden, March 26, 2022) and “ruin Russia” (German Foreign Minister Annalena Baerbock, Jan. 24, 2022).

Perhaps most shocking and revealing were the well-publicized comments by two unnamed White House “senior administration officials” at a background press briefing Jan. 25, 2022, detailing “the severity of the economic consequences we can and will impose on the Russian economy,” including “an atrophying of Russia’s productive capacity over time … [to] hit Putin’s strategic ambitions to industrialize his economy.” The two officials threatened that the United States, the UK and Europe “are unified in our intention to impose massive consequences that would deliver a severe and immediate blow to Russia.”

This was one month before Russia’s SMO began.

The dollar itself was quickly weaponized. On Feb. 24, leading Russian banks were put on the sanctions list, making it impossible for them to conduct business with the West. On Feb. 26, some $300 billion in Russian foreign reserves held in Western banks was seized—with the stated intent of expropriating it outright. On April 4, the U.S. Treasury took steps to make it impossible for Russia to make payments that were coming due on its foreign debt, in an effort to force an involuntary default with all of its consequences. On June 3, nearly all Russian banks, with only a handful of exceptions, were banished from the SWIFT international financial communications system—the long-threatened “nuclear option” designed to destroy the Russian financial system and economy altogether, by decoupling it from the West.

Throughout this period, Russia was denied access to Western technology, capital goods, and other economic inputs, in the stated expectation that this would plunge its economy into depression, create social chaos, and ultimately lead to the overthrow of President Putin.

The EU has marched in lockstep with the United States and UK on the sanctions policy from the very beginning, enacting 10 sets of measures since February 2022, with an 11th now under review.

Nor has Russia been the only country targeted with sanctions and related economic warfare. Others include China, Iran, Venezuela, Syria, Afghanistan and North Korea. In the case of Syria, the June 2020 Caesar Sanctions have been instrumental in destroying the Syrian economy, and leading to today’s 90% poverty rate in that country. In Afghanistan, the U.S. also “froze,” i.e., stole, nearly $9.5 billion in assets belonging to the Afghan central bank and stopped shipments of cash to the nation immediately after the Aug. 15, 2021 fall of Kabul, depriving the country of the minimal resources needed to alleviate hunger and even the deadly famine sweeping the country.

For good reason, Schiller Institute founder Helga Zepp-LaRouche on July 19, 2022 called for sanctions against Russia and other targeted nations to be immediately lifted:

The sanctions against Russia, but also all the other countries against which they have been imposed for years for geopolitical reasons—Iran, Venezuela, Cuba, Afghanistan, Syria, Yemen—must be ended immediately! Sanctions, under the conditions of world hunger, pandemic, and hyperinflation, mean genocide for developing countries, and suicide for our industry and agriculture!

This entire avalanche of sanctions was imposed on top of decades of debt looting of the Global South by the City of London and Wall Street. Small wonder, then, that the vast majority of the Global South now considers the dollar an unreliable currency, which is toxic and destructive. Small wonder that calls (and actions) for “de-dollarization” are spreading quickly across the Global South—as we also document below.

As the ratcheting up of sanctions came heavily into play in early 2022, the U.S. Federal Reserve began raising the Federal funds rate dramatically: On March 18, 2022, the first quarter-point rise occurred, and 2022 ended nine months later with the Fed rate at 4.33%.

The combination of these two processes brought to the surface a long-simmering discussion in the Global South about how to get out from under the toxic dollar system. Then on March 10, 2023, the U.S.’s Silicon Valley Bank failed, followed by Credit Suisse of Switzerland on March 19, and the implications of these bank failures led to a parallel discussion about Glass-Steagall in the United States and Europe.

Strengths and Weaknesses of Deliberations to Date

By and large, 2022 was a year in which there was a significant increase in discussion and policy studies around de-dollarization, with Russia, India, and China not surprisingly leading the way. But, with very few exceptions, actual concrete action in that direction began to be taken only in 2023, and those actions have continued to accelerate to date. On Glass-Steagall, the bank failures in the United States and Switzerland in March 2023 revived a discussion of that policy (mainly in Switzerland and the United States, predictably), the high point of which was the reintroduction of a Glass-Steagall bill to the U.S. Congress by Rep. Marcy Kaptur (D-Ohio) on April 19, 2023.

The strength of such discussions has been that fundamental changes are being seriously considered. The global sanctions regimen—especially as applied to Russia—made it clear that: (a) the toxic “Londollar” was no longer a trustworthy international reserve currency; and (b) the sanctions had failed, including the so-called “nuclear option” of banishing nations from the Belgium-based SWIFT international bank settlement system. It turned out that the City of London and Wall Street have more bark than bite—except, of course, the very real threat of the use of overwhelming military force to impose their will on subject nations, up to and including nuclear war with Russia and China.

But the weakness of the deliberations to date, in both the Global South and the West, has been that both sides remain largely unclear about what it takes to provide solid backing to that new currency: i.e., what is the true source of economic value. There has been too much tinkering with financial technicalities, and too little thinking about the scientific principles of physical economy. As important as it is to have trade settlements in local currencies; as important as it is to set up non-dollar swap facilities and even full-fledged clearing houses; the decisive issue is to be able to issue non-dollar Hamiltonian credit for productive infrastructure and other investments—and that goes for the United States and Europe as much as for the Global South.

For example, take the case of Ibero-America. The only way the Argentina-Brazil-BRICS vs. IMF conundrum (see below) will be solved, is by getting China’s Belt and Road Initiative actively underway in the region—to put “shovels in the ground” and start building the long-awaited bi-oceanic rail corridor(s) across the continent, in particular, based on multi-billion non-dollar credit lines. The value of those credit lines, and of the currency in which they are issued, depends entirely on the intent of the governments in question to develop the productive powers of labor, the “potential relative population density,” as Lyndon LaRouche proved in his groundbreaking paper in 2000, “On a Basket of Hard Commodities: Trade Without Currency.”

A Summary Chronology

The ‘Dollar as Weapon’ and the Response

In this summary chronology covering 2022–2023, sanctions are in bold; actions on de-dollarization are in normal roman type; Glass-Steagall restoration actions are in italics.

2022

Jan. 25, United States: Two unnamed White House “senior administration officials” explained to a “background press call”:

“We are prepared to implement sanctions with massive consequences that were not considered in 2014. That means the gradualism of the past is out, and this time we’ll start at the top of the escalation ladder and stay there.... And I would say the deepening selloff in Russian markets, its borrowing costs, the value of its currency, market-implied default risk reflect the severity of the economic consequences we can and will impose on the Russian economy in the event of a further invasion.... It would lead to an atrophying of Russia’s productive capacity over time. It would deny Russia the ability to diversify its economy … [and] hit Putin’s strategic ambitions to industrialize his economy.”

Feb. 23, European Union: The EU Council adopted its first set of sanctions against Russia. The EU website’s timeline included this statement:

“The measures are designed to weaken Russia’s economic base, depriving it of critical technologies and markets and significantly curtailing its ability to wage war.”

Feb. 24: The United States issued sanctions on Sberbank and its subsidiaries; full blocking sanctions on VTB Bank, Otkritie Financial Corp. Bank, Sovcombank and Novikombank and their subsidiaries, freezing their U.S. assets and prohibiting U.S. persons from dealing with them; and new debt and equity restrictions on Sberbank, Alfa-Bank, Credit Bank of Moscow, Gazprombank, Russian Agricultural Bank and other Russian companies.

Feb. 24, Germany: Foreign Minister Annalena Baerbock stated that the new package of EU sanctions “will ruin Russia…. What we are launching today is the political, economic isolation of the Russian regime.”

Feb. 26, European Union: EU Commission President Ursula von der Leyen announced on Twitter:

“We will paralyze the assets of Russia’s central bank. This will freeze its transactions. And it will make it impossible for the central bank to liquidate its assets.”

March 2: Seven Russian banks were removed from the SWIFT financial messaging service: Bank Otkritie, Novikombank, Promsvyazbank, Bank Rossiya, Sovcombank, Vnesheconombank (VEB) and VTB Bank.

March 8: The United States banned imports of Russian oil, gas and other energy fuels.

March 11, Russia, China: Dr. Sergey Glazyev, Russia’s Minister for Integration and Macroeconomics at the Eurasian Economic Commission, and Dr. Wang Wen, professor and Executive Dean of the Chongyang Institute for Financial Studies at Renmin University of China, each discussed the prospects for de-dollarization at a video conference between the Eurasian Economic Union and China.

March 15: The European Union banned supplies of energy-related equipment, technology and related services to Russia; banned new investments in the Russian energy sector; and tightened export restrictions on individuals connected to technology that could contribute to Russia’s defense and security sector.

March 15, Saudi Arabia: The Wall Street Journal posted an article headlined “Saudi Arabia Considers Accepting Yuan Instead of Dollars for Chinese Oil Sales.” It reported:

“Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan…. It would be a profound shift for Saudi Arabia to price even some of its roughly 6.2 million barrels per day of crude exports in anything other than dollars…. For China, using dollars has become a hazard highlighted by U.S. sanctions on Iran over its nuclear program and on Russia in response to the Ukraine invasion.”

March 17: The U.S. Treasury and Justice Departments set up the “Russian Elites, Proxies and Oligarchs (REPO)” task force “to find, restrain, freeze, seize, and, where appropriate, confiscate or forfeit the assets of those individuals and entities that have been sanctioned.” The REPO task force is comprised of “the U.S., Australia, Canada, Germany, Italy, France, Japan, the UK and the European Commission.”

March 22: In an interview with Foreign Policy, IMF First Deputy Managing Director Gita Gopinath said, “We are likely to see some countries reconsidering how much they hold certain currencies in their reserves,” and also making trade payments in other currencies or other forms of currency assets. She noted that the West’s confiscation of the Central Bank of Russia’s dollar- and euro-denominated reserves caused this reality.

March 23: Russian President Vladimir Putin announced that Russia’s gas exports would be paid for in rubles only:

“I have decided to implement … a package of measures to transfer payments … for natural gas supplied to ‘unfriendly countries’ to Russian rubles; that is, we will not accept any compromised currency to be used in these transactions.”

March 23–24: In a debate in the Indian parliament, External Affairs Minister Dr. Subrahmanyam Jaishankar said officials from several ministries are “examining various options,” including using rupees, so as to maintain commercial relations with Russia, according to Sputnik International. Officials of the Reserve Bank of India (the country’s central bank) met with officials from three large Russian banks—VTB, Sberbank and Gazprombank—to discuss a possible rupee-ruble payment mechanism for trade between the two countries, according to banking sources cited by India Times.

March 26: U.S. President Joe Biden, during a trip to Poland, tweeted:

“As a result of our unprecedented sanctions, the ruble was almost immediately reduced to rubble. The Russian economy is on track to be cut in half.”

March 27: Dr. Sergey Glazyev, Minister for Integration and Macroeconomics at the Eurasian Economic Commission of the Eurasian Economic Union (EAEU), told Business Online of discussions underway among specialists from Russia, China and India:

“We are currently working on a draft international agreement on the introduction of a new world settlement currency, pegged to the national currencies of the participating countries and to exchange-traded goods that determine real values.... Objectively, the ruble could become a reserve currency along with the yuan and the rupee. It would be possible to switch to a multi-currency system based on national currencies. But you still need some equivalent for pricing.”

March 31, Russia, India: Russian Foreign Minister Sergey Lavrov visited New Delhi, where one of the main topics of discussion was establishing ruble-rupee denominated payment mechanisms for increased Russian oil exports to India.

April 4: The U.S. Treasury announced measures to force Russia into involuntary default on its foreign debt.

“Beginning today, the U.S. Treasury will not permit any dollar debt payments to be made from Russian government accounts at U.S. financial institutions. Russia must choose between draining remaining valuable dollar reserves or new revenue coming in, or default.”

April 6: The United States announced full blocking sanctions on Sberbank and Alfa-Bank that will freeze any of the two banks’ assets which touch the U.S. financial system, and prohibit U.S. persons from doing business with them.

April 10: Russian Finance Minister Anton Siluanov pointed to Western-related Ukraine sanctions as a cause of BRICS nations drawing closer together. He told a meeting of finance ministers and central bank governors of the BRICS countries, chaired by China:

“The situation in the global economy has deteriorated significantly as a result of the sanctions. Bans on settlements, disruption of production and supply chains, export controls and import bans—all of these restrictions hit the global economy…. This pushes us to the need to speed up work in the following areas: The use of national currencies for export-import transactions, the integration of payment systems and cards, our own financial messaging system and the creation of an independent BRICS rating agency.”

April 25: Russia’s RT reported comments of Denis Manturov, head of the Russian Ministry of Industry and Trade, speaking in Uzbekistan and addressing countries within the Eurasian Economic Union (EAEU), BRICS, and the Shanghai Cooperation Organization (SCO). Manturov said:

“What is happening today in the global economy and in the world gives us a hint about how we need to rebuild our logistics, industrial cooperation, in what directions we can develop our economies. This [is] de-dollarization, and now we have added de-euroization, that is, the transition to our own currencies in order to be as independent as possible in terms of mutual settlements.”

May 25: The First Eurasian Economic Forum was held in Bishkek, Kyrgyzstan, with participation (either in person or online) of the heads of state and government of the five Eurasian Economic Union (EAEU) member states: Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan. Chairman of the Eurasian Economic Commission Mikhail Myasnikovich said:

“In my opinion, not only trade and payments in national currencies should be on our agenda. We need to discuss the construction of an independent monetary system, an independent currency system.”

June 3: The European Union announced its sixth round of sanctions, including the expulsion from SWIFT of additional Russian banks, including Sberbank, the country’s largest, with the aim to cut off the Kremlin from the global economy. The new sanctions also ban most Russian oil imports.

June 7: Russian Economist Dr. Sergey Glazyev told the plenary session of the International Forum of Public Diplomacy, celebrating the 5th anniversary of the Assembly of Peoples of Eurasia:

“We are on the threshold of the transition to a new monetary and financial system. I am convinced that in the next few years a new world settlement currency based on an international treaty will be introduced, international law will be restored…. [It] will work for the development of trade and cooperation.”

June 22: Russian President Putin addressed the BRICS Business Forum, meeting in Moscow:

“Together with BRICS partners, we are developing reliable alternative mechanisms for international settlements. The Russian Financial Messaging System is open for connection with the banks of the BRICS countries. The Russian MIR payment system is expanding its presence. We are exploring the possibility of creating an international reserve currency based on the basket of BRICS currencies.”

June 24, Argentina: President Alberto Fernández told a “BRICS-Plus” summit hosted by Chinese President Xi Jinping, that his country was applying for membership in the BRICS and its New Development Bank. Speaking as the president pro tempore of the Community of Latin American and Caribbean States (CELAC), representing 650 million people, Fernández said there is an urgent need for a new global financial architecture, in which the BRICS’ “economic and institutional weight can become a factor of financial stability,” and the expansion of the BRICS New Development Bank can help strengthen nations’ infrastructure. He also called for expanding currency swap arrangements such as the one Argentina has with China.

June 29: The U.S. Treasury’s REPO Task Force bragged that it has—

“blocked or frozen more than $30 billion worth of sanctioned Russians’ assets in financial accounts and economic resources; immobilized about $300 billion worth of Russian Central Bank assets; … and restricted Russia’s access to the global financial system, making it more difficult for Russia to procure technology.”

July 22, China: An article in China Daily featured de-dollarization moves.

“The weaponization of the dollar has aroused the concerns of other emerging market countries, and de-dollarization, which used to be a marginal idea, has now become a serious policy consideration for them. There is no doubt that geopolitical risks, cyclical liquidity risks and inflationary crises created by the dollar system have emerged at the same time, with dire consequences. Moreover, the U.S.’ own over-indebtedness and stagflation also damage the long-term credibility of the dollar. This has led some emerging economies to reassess the role of the dollar.”

Aug. 2: A China Daily editorial took up the impact of Federal Reserve interest rate hikes:

“What is certain is the negative spillover effects caused by the Fed’s moves are building up for the rest of the world. That means the U.S. is taking advantage of the dollar’s status as international currency to diffuse its inflation worldwide…. The moves will prompt the outflow of capital from other countries, particularly the emerging market economies as well as those with high debts and leverage levels, sapping the foundation of their already unstable recovery.”

Aug. 11, India, Russia: India announced switching to non-dollar payments in its deals for Russian coal.

Aug. 21, China, Russia: China’s General Administration of Customs announced that July purchases of oil from Russia rose by 7.6% from 2021 to 2022, making China the largest purchaser of Russian oil—as well as coal. Transactions between the two countries are carried out principally in local currencies.

Aug. 21: Russian Deputy Foreign Minister Alexander Pankin told TASS:

“We have been focusing on de-dollarization efforts, import substitution and work to strengthen our technological independence.... It is encouraging to see that many nations, seeing extraordinary and illegitimate sanctions against Russia, are thinking about the need to de-dollarize foreign economic activity to ensure their sovereignty. As it turned out, if there is political will, the issue is quite solvable.”

Sept. 8, United States, Afghanistan: Special Representative of the UN Secretary General for Afghanistan, Deborah Lyons, told the UN Security Council that the U.S.’s freezing of $9.5 billion dollars in Afghan assets would inevitably spark “a severe economic downturn” and could push millions more Afghans into poverty and hunger. She called for the funds to be released, “to prevent a total breakdown of the economy and social order,” which could set Afghanistan “back for generations.”

Sept. 14, China: A Global Times unsigned opinion column, “Non-Dollar Settlement in Energy Trade Will Break US hegemony,” began:

“As the U.S. Federal Reserve’s monetary tightening policy is set to wreak havoc and cause shocks across the global economy, there is increasing urgency for China, Russia, and other economies to step up cooperation to break the U.S. dollar’s dominance in the energy market…. To break the dollar’s dominance, it is essential to first weaken its anchor with major energy products such as crude oil. With the Fed’s irresponsible monetary policy now plunging the world economy into a tempest, more countries have been waking up to the growing urgency of breaking the dollar’s dominance in global energy trading. It has become more frequent than ever to see crude oil producing countries and consuming countries use non-dollar currencies to settle their energy trade in recent months.”

Oct. 16, Indonesia: Indonesian Central Bank official Nugroho Joko Prastowo called for switching to “Local Currency Settlement” (LCS) to reduce dependency on the dollar. He noted that four countries have agreed to utilize LCS with Indonesia so far: China, Japan, Thailand and Malaysia. Singapore and the Philippines will join soon, and “the implementation of LCS with Saudi Arabia is also being explored,” he said.

Nov. 1, Russia: At the Shanghai Cooperation Organization online meeting hosted by China’s Prime Minister Li Keqiang, Russian Prime Minister Mikhail Mishustin stated:

“Our common task is to gain independence from the influence of third countries in the financial sector. For that purpose, we suggest creating a digital system for the exchange of financial information and payment transactions within the SCO.” [This would provide economies with] “more predictable, clear and reliable conditions.”

Nov. 10, Syria, United States: UN Special Rapporteur on unilateral coercive measures and human rights Alena Douhan issued a report calling for the lifting of NATO nations’ unilateral sanctions against Syria:

“I am struck by the pervasiveness of the human rights and humanitarian impact of the unilateral coercive measures imposed on Syria and the total economic and financial isolation of a country whose people are struggling to rebuild a life with dignity, following the decade-long war.”

Dr. Douhan added that 90% of Syria’s population is currently living below the poverty line, and that blocking of payments and refusal of deliveries by foreign producers and banks, coupled with sanctions-induced limited foreign currency reserves, have caused serious national shortages in medicines and specialized medical equipment in Syria.

Nov. 18, United States: A resolution calling on Congress to re-enact the Glass-Steagall Act was passed at the winter convention of the Kansas Cattlemen’s Association (KCA), titled: “Resolution: Re-enact Glass-Steagall Law for Sound Banking and Credit To Rebuild the Nation.”

Dec. 9, China, Saudi Arabia: Gulf News reported: “President Xi Jinping, hosted by Saudi Crown Prince Mohammed bin Salman, told Gulf Arab leaders that China would work to buy oil and gas in yuan, a move that would support Beijing’s goal to establish its currency internationally.”

Xi said the Shanghai Petroleum and Natural Gas Exchange would be “fully utilized in RMB (yuan) settlement in oil and gas trade.”

Dec. 27, Russia: An op-ed by Russian economists Dr. Sergey Glazyev and Dmitry Mityaev, in the Moscow business journal Vedomosti on the “Golden Ruble 3.0,” made the case for using gold to protect the Russian financial system:

“Russia, together with its eastern and southern partners, has a unique chance to ‘jump off’ the sinking ship of the dollar-centric debt economy, ensuring its own development and mutual trade in the accumulated and extracted strategic resources. [Russia must deal with] the accumulation of multibillion-dollar cash balances on the accounts of Russian exporters in ‘soft’ currencies in the banks of the above partner countries.... This money is also subject to exchange rate and possible sanctions risks, it becomes necessary to sterilize their excess mass. The best way is to buy non-sanctioned gold.”

2023

Jan. 10, Singapore: At a conference of the ISEAS-Yusof Ishak Institute, George Yeo, former foreign minister of Singapore, stated: “The U.S. dollar is a hex on all of us. If you weaponize the international financial system, alternatives will grow to replace it” and the U.S. dollar will lose its advantage. At the same conference, former Indonesian Trade Minister Thomas Lembong applauded Southeast Asia central banks that already have developed direct digital payments systems with local currencies and encouraged officials to find more ways to de-dollarize:

“I have believed for a very long time that reserve currency diversification is absolutely critical.”

Jan. 14, Germany: At a Council of Europe assembly, Germany’s Foreign Minister Annalena Baerbock infamously said,

“We are fighting a war against Russia.”

Jan. 17, Saudi Arabia: Finance Minister Mohammed Al-Jadaan told Bloomberg at the World Economic Forum in Davos, Switzerland:

“There are no issues with discussing how we settle our trade arrangements, whether it is in the U.S. dollar, whether it is the euro, whether it is the Saudi riyal.”

Feb. 24: The U.S. Treasury announced a new round of punitive sanctions on “numerous Russian banks and is also targeting wealth management–related entities and individuals that play key roles in Russia’s financial services sector.”

March 9, United States: CNN reported that, despite having “blocked or seized more than $58 billion worth of assets owned or controlled by sanctioned Russians in the past year,” further sanctions were required.

March 15, China, Saudi Arabia: The Export-Import Bank of China and the Saudi National Bank, the largest commercial bank in Saudi Arabia, issued a joint yuan loan for the first time.

March 16, United States: In hearings in the Senate Committee on Finance, Sen. Maria Cantwell (D-WA) asked Treasury Secretary Janet Yellen:

“What about Glass-Steagall? I’ve been a big supporter of Glass-Steagall and when it comes to this moment, and I keep thinking, why did we ever allow us to have the commingling of separation of commercial and investment banking?... I’m really just asking if you thought the same situation would have occurred [the failure of Bank —ed.], the way it occurred, if we had not in 2000 gotten rid of Glass-Steagall.”

Secretary Yellen responded: “I think there will be plenty of time [when] it will be appropriate to look at what happened and consider whether or not regulatory or supervisory changes are necessary.”

March 17, Italy: Tommaso Foti, the head of the faction in the Chamber of Deputies of the Fratelli d’Italia, the party of Prime Minister Giorgia Meloni, introduced a bill for reinstating a Glass-Steagall type of banking separation. The bill was sponsored by Foti and 14 party colleagues, including former Economics Minister Giulio Tremonti. According to press accounts, the bill gives banks 12 months to reorganize their operations and choose between commercial and financial investment activities.

March 17, Switzerland: Peter Burkhardt, head of the business department at the Zurich-based TX Group AG (formerly Tamedia Group AG), called for bank separation in an article in the Berner Zeitung. Burkhardt said:

“Asset management and commercial banks should be separated from investment banks…. A few years ago, it was adopted in the National Council with votes from the [Swiss People’s Party] SVP, [Social Democrats] SP and Greens—and then scuttled in the Council of States.”

March 17–18, Switzerland: Thomas Matter of the Swiss People’s Party (SVP) and Green Party President Balthasar Glättli spoke out on March 17 in favor of a bank separation system in a television interview. According to media accounts,

“Glättli recalled an attempt in 2011 to introduce a banking separation system that would have to separate high-risk business areas.”

On March 18 Benjamin Fischer, an SVP member of the National Council (lower house), called for Glass-Steagall (“Trennbanken”) legislation. He tweeted about the failure of Credit Suisse:

“A Black Day for the Swiss financial center. In the past, we missed the chance: instead of a stable bank-separation system, we have now not only a too-big-to-fail bank, but a too-big-to-rescue giant. Will we get the needed majority now?”

March 27, Switzerland: Neue Zürcher Zeitung reported:

“The most obvious solution, which is now being pushed again by the left, but is also gaining supporters among the bourgeoisie, is to split up the big banks. One part would house the ‘risky’ investment banking, such as trading in stocks, bonds and derivatives. The other part would concentrate on the ‘boring’ deposit and credit business, such as the cantonal banks or Raiffeisen banks.”

March 28, China, UAE: China completed its first trade of liquefied natural gas (LNG) settled in yuan, the Shanghai Petroleum and Natural Gas Exchange announced. Chinese state oil and gas giant CNOOC and France’s TotalEnergies agreed to import around 65,000 metric tons of LNG from the United Arab Emirates (UAE), according to Oilprice.com.

March 28, ASEAN: All ten ASEAN finance ministers and central bank governors met in Indonesia and agreed to work out a Local Currency Transaction scheme, making their financial transactions in local currencies, and avoiding their previous dependence on the dollar, euro, yen, and pound.

March 29, Russia, India: Russian state energy company Rosneft announced that Moscow and New Delhi have made an agreement that will “substantially increase” the supply of Russian crude oil to India, and also diversify its grades. The deal was reached with the Indian Oil Company during a trip by Rosneft CEO Igor Sechin. Rosneft’s press release referred to discussions of wider cooperation in the energy sector and possible trade settlements in national currencies. Russian Deputy Prime Minister Aleksandr Novak reported that Indian purchases of Russian oil surged more than 20-fold in 2022.

March 29: India announced it will accept rupee payment for exports to 18 “countries facing dollar shortages or currency crises,” and is also exploring a Russia-India-China alternative to SWIFT, according Modern Diplomacy, anticipating that U.S./EU sanctions could be extended to them as well. One such established deal is a rupee trade mechanism with Iran for crude oil imports. Another, reported by the Bangladesh website, The Business Standard, is an agreement for some $2 billion equivalent in exports from Bangladesh to India to be completely transacted in rupees and takas.

March 29, Brazil, China: China’s Vice Minister of Commerce, Guo Tingting, announced at a business forum in Beijing:

“An agreement on settling payments in yuan has been signed with Brazil, which greatly facilitates our trade. We are planning to expand cooperation in the field of food and mineral extraction, and to search for a possibility of exporting goods with high added value from China to Brazil and from Brazil to China.”

Sputnik News further reported that Brazil and China announced the establishment of a clearing house that would provide for settlements without using the U.S. dollar. It would also lend in national currencies, circumventing the use of the dollar.

March 29, United States: Sen. Marco Rubio (R-FL) warned on Fox News’ “Hannity” show:

“Just today, today, Brazil, in our hemisphere, the largest country in the Western hemisphere south of us, cut a trade deal with China. They’re going to, from now on, do trade in their own currencies to get right around the dollar…. We won’t have to talk about sanctions in five years because there will be so many countries transacting in currencies other than the dollar that we won’t have the ability to sanction them.”

April 3, Russia: Speaking in New Delhi at an event of the St. Petersburg International Economic Forum, Alexander Babakov, Deputy Speaker of Russia’s State Duma, reported that the BRICS are likely to create a “fundamentally new” common currency, because “neither the euro nor the dollar is backed by anything, and our countries can do what the Bretton Woods system destroyed.” The new currency, he explained, would be backed not only by gold, but by “real resources,” such as land or rare earth minerals, according to an account in Pressenza.

India’s WION reported the news about a new currency under the headline, “BRICS common currency soon? India, China step up to counter U.S. dollar’s dominance.” It added that Babakov said such an arrangement could be announced as soon as the Aug. 22 BRICS heads-of-state summit in South Africa.

April 26, Argentina, China: Argentine Finance Minister Sergio Massa, with Chinese Ambassador Zou Xiaoli, announced that Argentina will now be able to pay for imported intermediate goods from China in yuan rather than dollars, thanks to the currency swap existing between the People’s Bank of China and the Central Bank of Argentina. As a result of this decision, Massa added, “a volume of imports in yuan for over $1 billion has been programmed to replace the use of dollars in Argentina.”

April 10, Russia, China: The Central Bank of the Russian Federation announced that the yuan/ruble pair represented 39% of trading on the Russian currency market in March, displacing the U.S. dollar/ruble (which fell to 34%) as the largest pair. A May 8 China Daily article headlined, “Yuan’s global march gathers momentum,” described this as part of “the tectonic shift currently underway in currency markets.”

April 10, Switzerland: Several newspapers of the CH Media group of Switzerland, including Luzerner Zeitung, St. Gallen Tageblatt and Aargauer Zeitung, ran an article by Washington correspondent Renzo Ruf on the battle for the Glass-Steagall Act starting again in the United States. The article, “Back to the Future: Is the U.S. Again Facing a Debate on Breaking Up the Banks?” reports:

“After the recent turmoil, some Democrats and Republicans in Washington are again calling for the introduction of a bank separation system. Could the split of commercial banks and investment houses prevent the next crisis? Politically, they don’t make hay in the same field. Sen. Josh Hawley, 43, is a right-wing hardliner, Rep. Marcy Kaptur, 76, is a moderate leftist. But the Republican and the Democrat agree on one issue; after the turbulence in the American banking sector, the country would be well-advised to go back to a bank separation system.”

April 14, Brazil: President Lula da Silva stated, in remarks to officials of the BRICS New Development Bank after the investiture of former Brazilian President Dilma Rousseff as president of the bank:

“No bank should be asphyxiating countries’ economies the way the IMF is doing now with Argentina, or the way they did with Brazil for a long time, and every third-world country. No leader can work with a knife to their throat because [their country] owes money.” [The NDB must be a bank] “that makes a difference.… I think that, never more than today has the world needed an instrument to help development in the world. Why can’t a bank like the BRICS bank have a currency to finance trade between Brazil and China, between Brazil and other BRICS countries? Today, countries have to chase after dollars to export, when they could be exporting in their own currencies…. I think that the 21st Century can change our minds and can help us, who knows, to do things differently.”

April 19, United States: Rep. Marcy Kaptur (D-Ohio) introduced her Return to Prudent Banking Act of 2023 to reinstate essential provisions of the 1933 Glass-Steagall Act, including the restoration of the separation between commercial and investment banking. Her statement prominently notes: “The legislation has been endorsed by the Schiller Institute and the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO).” Kaptur stated:

“The 2008 financial crash nearly took down our entire economy and led to the great recession wiping out the income and savings for many Americans. The recent collapse of Silicon Valley Bank in California and Signature Bank in New York echoes the 2008 collapse with speculators squeezing through every regulatory keyhole to find an avenue to game the system. In 2023, here we are again, watching bank runs, failures, and massive buyouts. Wall Street has proven that it cannot control itself, and it is only a matter of time before it steers America into the next financial crisis.”

The bill, designated as House Resolution 2714, is now co-sponsored by 16 Representatives.

April 21: Bank of Indonesia Governor Perry Warjiyo announced at a press conference that Jakarta has introduced transactions in the local currency to settle cross-border trade. As reported by SINDOnews, he stated: “Indonesia has initiated diversification of the use of currency in the form of LCT [local currency trading]. The direction is the same as the BRICS. In fact, Indonesia is more concrete.”

Indonesia has arranged with Thailand, Malaysia, China, and Japan to use LCT. South Korea is scheduled to sign a cooperation agreement with Indonesia early in May.

April 27, Argentina, China: Argentina decided to shift from the dollar to the yuan for all settlements of imports from China starting from May, said a statement published by China’s embassy in Argentina.

April 28, France: Four economists of the Institut La Boétie (ILB)—a think-tank co-organized by the head of La France Insoumise (LFI) movement, former Senator Jean-Luc Mélenchon—published a report on the banking crisis. It states:

“One of the main measures must be the separation of retail and investment banking activities, and investment banking. This measure, which the banking lobby has always opposed, has proven its effectiveness in the past: financial historians have shown that the Glass-Steagall Act (1933), adopted following the 1929 crisis, contributed to the stability of the U.S. banking system in the decades that followed. France had also instituted in 1945 a separation of deposit-taking, medium- and long-term credit, and investment activities, which also brought stability in the post-war period.”

May 1, Switzerland: Magdalena Martullo-Blocher, daughter of Swiss People’s Party (SVP) founder Christoph Blocher and herself an MP in the Swiss National Council, said in an interview with the Zürich-based Watson News portal:

“After the state bailout of UBS, the SVP, together with the left, wanted to push through a bank separation system.”

May 2, Brazil, Argentina: After meeting with Argentine President Alberto Fernández in Brasilia, Brazilian President Lula da Silva stated:

“I’ve already spoken with the BRICS and we’re going to continue talking to see how we can help” Argentina. He suggested the NDB might get involved by providing guarantees for financing Brazilian exporters. “We don’t want them to lend money to Argentina,” he said. “We want them to give us guarantees which would greatly facilitate Brazil’s relations with Argentina.” The Brazilian Presidency’s website reported that when Lula was in China in mid-April, he spoke both with Rousseff and with China’s President Xi Jinping about helping Argentina. Rousseff told Lula that she had discussed Argentina’s case with China’s Foreign Minister Qin Gang, and is looking at various options by which the NDB might play a role.

May 5, Russia: Foreign Minister Sergey Lavrov spoke to reporters at the May 4–5 Shanghai Cooperation Organization ministerial meeting in India. According to a report by Yahoo News, Lavrov—

“noted the widening trade deficit with India, which has been a top buyer of Russian oil since Moscow launched its war on Ukraine last year. As for rupees, this is a problem because there are billions of rupees accumulated in accounts at Indian banks and we need to use this money. For this, rupees should be converted into other currencies. This is being discussed.”

May 8: Pakistan reached an agreement to pay for urgently needed oil imports from Russia not with dollars, but with Chinese yuan. An unnamed official from Pakistan’s Ministry of Energy told News International the transaction would be facilitated by the Bank of China, at a price of about $50–52 per barrel.

May 8, Malaysia: Former Prime Minister Mahathir Mohamad told Global Times:

“Long ago I suggested a trading currency to be used only for trade in the ASEAN region, as well as the Northeast Asian countries. That means Japan, South Korea, and China…. The feeling in the world today is changing. Before, they accepted the Bretton Woods Agreement, which says that trade should be conducted in the U.S. currency; now many countries want to use other currencies. My suggestion, that we should have a currency for trading in East Asia, is now something that is acceptable to many countries.”

May 14, China: Zhou Yu, director of the Research Center of International Finance at the Shanghai Academy of Social Sciences, told Global Times:

“Despite the daunting difficulties such an effort faces, it is not entirely impossible for these nations to have such a currency unit…. Currently the effort by BRICS nations seems to be focused on devising a currency unit used specifically to settle cross-border trade, rather than a currency unit to replace other local currencies, which reduces the difficulty of such efforts and increases its plausibility.”

May 22, Russia: Prime Minister Mikhail Mishustin met with Dilma Rousseff, the new president of the BRICS New Development Bank (NDB), and said:

“You are heading the bank at a difficult time, that is, during the transformation of the global trade and economic financial system. We believe that efforts to shield trade and economic ties between BRICS countries from the impact of illegitimate collective Western sanctions are among the bank’s main goals.”

May 22, Russia: Andrey Kostin, Chairman of Russia’s VTB Bank, stated at the Russian-Chinese Business Forum in Shanghai:

“China is now the world’s second-largest economy and will soon become the first. There is every reason to expect that the Chinese yuan will replace the U.S. dollar as the world’s main reserve and settlement currency as early as the next decade. In fact, the Central Bank of Russia is already investing its reserves in yuan, and more than 70% of trade turnover between Russia and China is settled in yuan together with the ruble.”

May 23, Russia: Herman Gref, Chairman and CEO of Russia’s largest state-owned bank, Sberbank, told the Russian-Chinese Business Forum in Shanghai that the yuan is rapidly coming to dominate Russian-Chinese trade:

“In 2023, we expect a tenfold increase in the number of transactions in yuan compared to last year.”

May 23, Indonesia, Iran: President Ebrahim Raisi of Iran met with Indonesian President Joko Widodo in Jakarta and signed 11 cooperation agreements, which included announcing that they would carry out trade in their national currencies.

May 24, Russia: The second Eurasian Economic Forum of the Eurasian Economic Union (EAEU) met in Moscow, along with leaders of the Shanghai Cooperation Organization and the BRICS. In total, 54 nations were represented. The Modern Diplomacy platform reported May 23:

“The session participants will discuss key areas of cooperation, the effects of implementation of a transport and logistics megaproject in Greater Eurasia for Eurasian Economic Union countries, prospects for monetary and financial cooperation, the transition to new forms of settlements for mutual trade between the countries of these integration associations in the current conditions, as well as the role of collaboration between the associations in stabilizing the general economic situation around the world.”

May 24, Belarus: President Aleksandr Lukashenko was quoted on the Republic of Belarus website:

“China is now actively developing its own interbank payment system. Brazil and Argentina have decided to create a common currency. South Korea and Indonesia, India and Malaysia have agreed to abandon the dollar in domestic payments. In the East the establishment of an Asian monetary fund is under consideration. Saudi Arabia has decided to abandon the U.S. dollar as the sole currency for oil trade. And this is just the beginning.”

The government website said further that,

“The Belarusian president believes that in the near future the world will have new powerful currency unions with a new reserve currency. The Russian ruble, the Chinese yuan, the Brazilian peso, or the Indian [rupee]? With what will countries start paying each other? There is no answer to this question yet. But one thing is clear: The era of the U.S. dollar is really coming to an end.”

May 24: Russian President Vladimir Putin told the Eurasian Economic Forum, “sweeping changes [are] underway in international finance” in the development of a “new and decentralized global financial system,” based on trade in national currencies.

Putin said Russia is pursuing a policy of “reducing the share of unfriendly countries’ currencies in mutual transactions and planning to expand our activities with our partners around the world, including the EAEU, in order to complete the transition to national currencies.” India, China, Latin American countries are already switching to national currencies in their foreign trade settlements, he pointed out. “It is important to coordinate our efforts to create a new and decentralized global financial system.”

May 24, Switzerland: The federal government rejected a draft bill for bank separation filed April 11 by Swiss Green Party member Franziska Ryser. The Federal Council only committed to preparing a report “to be submitted to Parliament within a year…. This report will also deal in depth with the question of whether measures in the area of a separation banking system are indicated. Therefore, the Federal Council cannot commit to concrete measures in this area at the present time.”

May 28, Saudi Arabia: The government is interested in joining the BRICS’ New Development Bank, the Financial Times reported, and “is also pursuing closer relations with China.” Saudi Arabia has reportedly also applied to join the BRICS itself.

May 29: Russian Foreign Minister Sergey Lavrov stated in Nairobi, Kenya:

“As trade grows, the transition to payments in national currencies will take on a practical meaning. It is the future. This goes beyond Africa to include transactions in national currencies with Latin America and our partners in Asia, Iran, India, and China…. Speaking of Latin America and the upcoming BRICS summit, President of Brazil Lula da Silva put forward an idea to prioritize the development of payment mechanisms that do not depend on the U.S. dollar or the euro. They will rely on the decisions and agreements developed within the BRICS New Development Bank, among others. This process will pick up steam.”

May 29: Brazilian President Lula da Silva stated at a joint press conference with visiting Venezuelan President Nicolás Maduro of Venezuela:

“I dream of having a common currency so that our countries can use it for transactions, in order to be independent from the dollar. It can’t be the case that we cannot have greater freedom to conduct our business. I dream of the BRICS having their own currency, like the European Union has the euro.”

May 30, Brazil: President Lula da Silva told a meeting of the Union of South American Nations (UNASUR) that the region should—

“deepen our South American identity also in the monetary area, through more efficient clearing mechanisms and the creation of a common reference unit for trade, reducing dependence on extra-regional currencies.”

Lula explained his motivation:

“And I conclude paraphrasing Ambassador Samuel Pinheiro Guimarães, who was Secretary General of Itamaraty [Brazil’s Foreign Ministry —ed.]: We must refuse to spend another 500 years in the periphery. The human and material conditions for our sovereign development are in our hands.”

May 31, BRICS: In an interview with CGTN, New Development Bank (NDB) President Dilma Rousseff stated:

“I believe that in the current world there is a growing trend to promote commercial exchanges using local currencies.... For example, the petroleum market is a significant field in today’s currency exchange. We now see when China and Saudi Arabia have their own oil trading, both countries use local currencies to conduct trade. RMB [renminbi] is the currency that the two countries use. Another example is countries in the Global South are increasingly using local currencies for trade payments.

“What we are proposing is that part of the financing for the member countries should be settled in their local currencies. This type of financing can also be carried out using the currencies of other developing countries or emerging market countries in the currency basket.”