Editor's Note: This article first appeared in EIR, Vol. 35, No. 48, December 12, 2008, p. 39-40.

Dec. 3—BFM.ru, the new Internet portal of the Russian economics radio station Business FM, today published an interview with U.S. economist Lyndon LaRouche, under the headline “The Present Monetary System Is the Disease.” Correspondent Natalya Bokareva, to whose written questions LaRouche replied on Nov. 27, introduced the interview: “The only way to save the world economy is to return to Bretton Woods. The cosmetic changes, proposed by the G-8 and the G-20, will not save the world. The American economist Lyndon LaRouche presents this viewpoint in an interview with BFM.ru.”

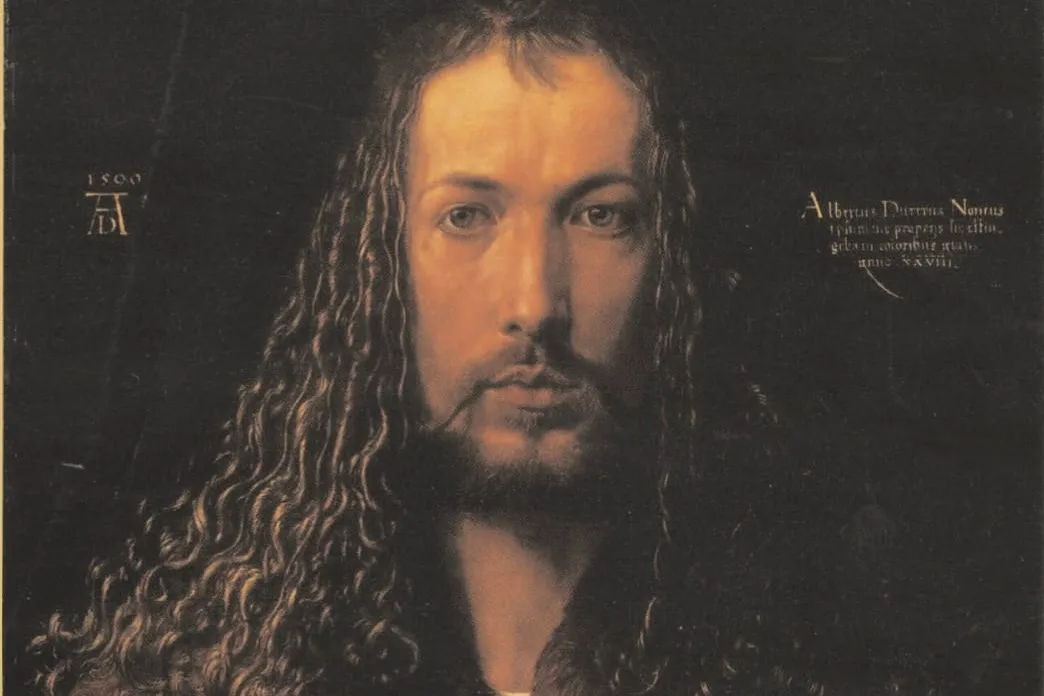

Illustrated with a photo of LaRouche addressing an audience in Washington on Nov. 18, the BFM.ru publication provides partially correct biographical information on LaRouche, including that he was author of the Strategic Defense Initiative, and that he was jailed, but was released ahead of time after advocacy on his behalf by numerous influentials. The introduction also notes that as an “anti-globalist,” LaRouche calls for returning to “the original American System.”

Today, BFM.ru stresses, “LaRouche calls for the world to return to the economic prescriptions of Roosevelt, and to a credit system, rather than a monetarist global financial system.”

Here is the interview, in English translation. It may be viewed in Russian at www.bfm.ru/news/2008/12/03/larush.html.

A Credit System, Not a Monetary System

BFM.ru: Many officials keep repeating that the global financial system needs reforming. In your opinion, what will this new order mean—creating some new regulatory institutions, or reorganizing the existing ones (the IMF, the World Bank) to change their core profile and activities? What is possible and necessary to implement in the near future?

Lyndon LaRouche: All proposed reforms which were situated within the context of the present monetary system would fail disastrously. It is the present monetary system itself which is the disease. It can not be cured; it can only be replaced. Any attempt to reform the present system would be a quick step toward a great disaster.

What is required is the replacement of the existing monetary system by a credit system modelled upon the intention of the Federal Constitution of the U.S.A., as President Franklin D. Roosevelt had intended such a reform in his presentation of what he defined as a Bretton Woods System.

The confusion on this issue arises because the IMF installed by the British and Truman’s U.S.A. was a monetarist system, not a credit system. The source of the potentially fatal confusion among most governments on this matter is a result of the fact that President Franklin Roosevelt was anti-colonialist, and intended his IMF reform to eradicate colonialism and similar abuses. Truman, a right-winger allied to Churchill, used the opportunity created by President Roosevelt’s death to defend previously established British imperialist and other colonial arrangements. The British empire now rules the world, at least temporarily.

With the floating of the U.S. dollar, by President Nixon, in 1971, the dollar ceased to be a sovereign currency, and was degraded, step by step, to becoming a plaything of an Anglo-Dutch Liberal monetarist system. It is that now hopelessly bankrupted, monetarist system, itself, which has entered the phase of terminal collapse. All nations which continue to seek reforms within the existing monetary system will simply disintegrate at some early time, perhaps as early as months away.

Russia would be a first choice of a possible initiator of such a reform, were the U.S.A. to join Russia in such an action. Then, China, which desperately needs such a solution, and India, whose situation is somewhat less critical at the moment, would form a group of four which would be the nucleus, around which to rally other nations as members. Such an action would be almost certainly successful; no alternative to that is visible.

Money Has No Intrinsic Value

BFM.ru: In your opinion, how relevant is the need for stricter oversight over global corporations and, particularly, for control over speculative capital movements?

LaRouche: Ruthless enforcement against freedom for speculative forms of financial-capital movements is necessary for any nation which intends to outlive the now rapidly approaching general breakdown-collapse of all existing monetarist systems.

Money has no intrinsic value. That is why all conventional economists have been complete failures in their attempts at long-range statistical-economic forecasting. There is no way that money values could come kinematically into functional correspondence with human values. Forecasting, in which I have the best record of anyone so engaged, must be approached in terms of physical-capital and science-technological factors, not statistical theories.

Money values must be regulated within reasonable ranges of estimates; such systems are called protectionist systems. People who think only in terms of buying and selling today, are ignorant of the decisive role of long-term capital improvements in production and basic economic infrastructure.

Not only must protectionist measures defend long-term capital requirements, but they must include increasingly high rates of technological improvements in effective productivity of physical capital, as measured per capita and per square kilometer. These capital formations involve spans of a quarter- to a half-century and longer. The ensuring of needed long-term physical capital formation and of increase of the energy-flux density of power per capita and per square kilometer of territory, must be built into the policy-making process. For example, the increase of the energy-flux density of power sources (which means nuclear-fission and nuclear-fusion densities) is indispensable for meeting the conditions of life required for the present level of population of the planet. Without a fixed-exchange-rate system, no long-term success of any modern economy could be possible.

Forget the G-7 et al.

BFM.ru: The G-7 today is a kind of a representative club which is not a decision-making body. In your opinion, is it necessary to expand the membership in this elite club and change its principles of functioning? Should this include creating a new global regulatory body competent in making decisions which are obligatory for its members?

LaRouche: Forget the G-7 and kindred arrangements. They are only coffins within which the memory of disintegrated national systems who join them will soon be buried. It is necessary to create a new system. The only workable first step would be to create a nucleus for a new world credit system (not a monetary system) of the form which President Franklin Roosevelt had actually intended. It must be a fixed-exchange-rate credit-system, not a monetary system.

BFM.ru: Currently, the ideas of reorganizing the global financial system are promoted by different officials in different countries. Can you see a political leader authoritative and powerful enough to grasp and unify all the views and drive this revolution?

LaRouche: Presently, all governments are behaving very foolishly on these issues. One must hope that sheer terror will improve their intentions. The terror will be a runaway hyperinflation which will be comparable, on a worldwide scale, to what Germany experienced during October-November 1923. That development is already under way, globally, at this moment. The banking systems of the world are already accelerating their inflation toward early breakdown prospects. I present the design for the remedy. If my design is adopted, civilization will survive the months ahead. If not, we must hope some nations of the distant future, after a prolonged, planet-wide, new dark age, will be wiser than the present ones.