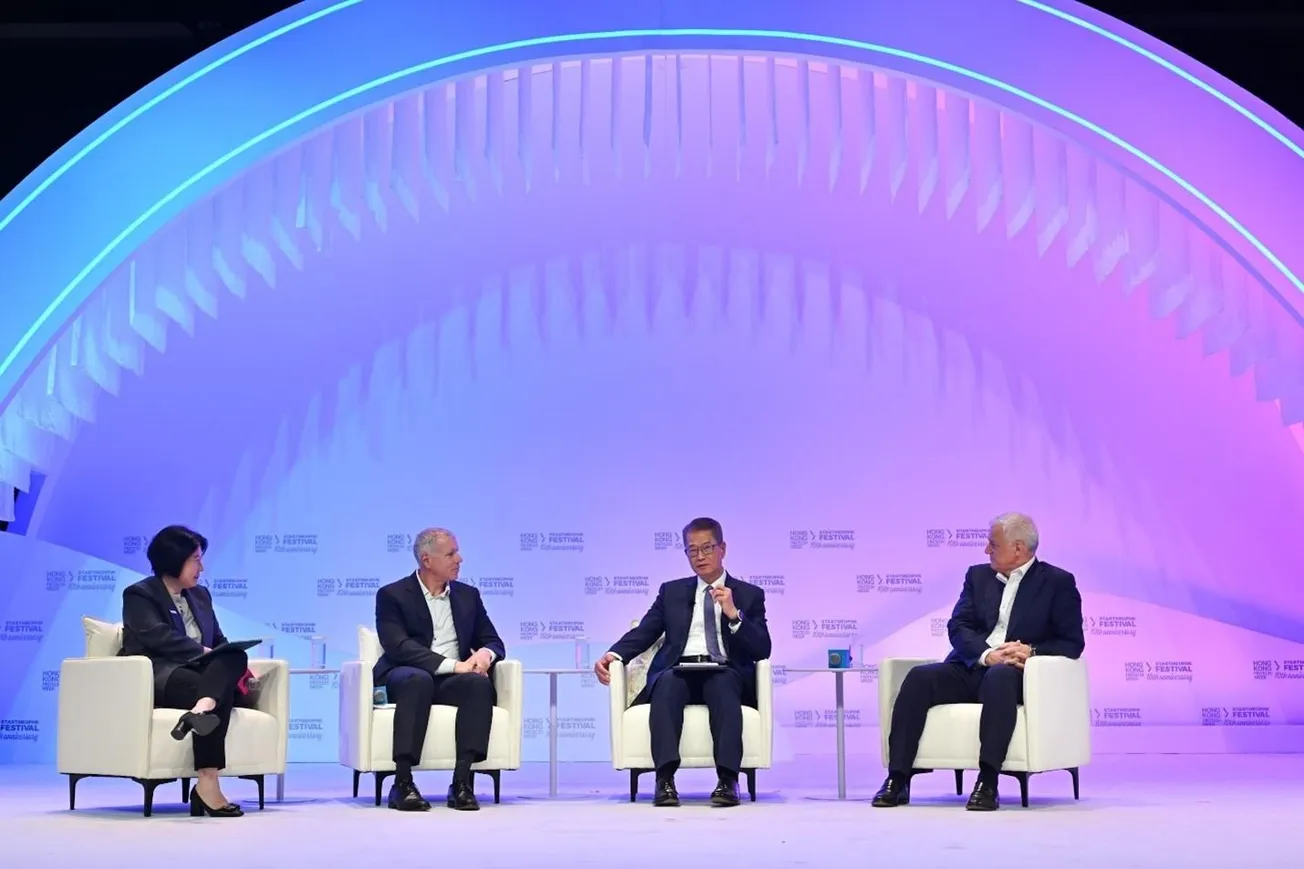

During a financial summit in Hong Kong on Nov. 4, the CEO’s of two of the leading investment firms sounded the alarm about an impending financial downturn. “It’s likely there’ll be a 10 to 20% drawdown in equity markets sometime in the next 12 to 24 months,” said Goldman Sachs CEO David Solomon, reported the New York Post. Solomon tried to put a positive spin on it, saying “Things run, and then they pull back so people can reassess… It’s not something that changes your fundamental, your structural belief as to how you want to allocate capital.”

Also speaking in Hong Kong, Morgan Stanley CEO Ted Pick voiced the same thought. “We should also welcome the possibility that there would be drawdowns, 10 to 15% drawdowns that are not driven by some sort of macro cliff effect,” he said. The gentle warnings were enough to set off a small plunge in stocks Tuesday, led by the leading AI and tech companies—a domain many see as “overvalued” given the trillions in investment over the recent period.