This is part two of a two-part article. Part one is available here.

The revolutionary thesis of Lyndon LaRouche’s Dope, Inc. was that, as despicable and damaging as the drug trade is, the real agenda of those ultimately behind it was much more sinister: to destroy the United States as a Republic, and to stamp out that principle in every corner of the globe. Drugs and drug money were merely the chosen weapons in that larger crime.

Similarly, as evil and disgusting as Epstein’s lurid behavior was, he was simply a tool for an international oligarchy intent on destroying sovereign nations and productive economies. Their intent is nothing short of a global fascist dictatorship, and that commitment outlives any particular tool. That oligarchy is the real target of any honest investigation, not the simple list of names in a file or black book.

Please read the following initial inquiry with that in mind.—Kevin Pearl

Introduction to Part Two

In his short preface to the 1992 edition of Dope, Inc., Lyndon LaRouche provided a concise review of the evolution of the international drug trade, from the time of the rise of the Sufi mystics, through Adam Smith’s British East India Company, to the emergence of the international narco-terrorist operations which threaten civilization today. This latest phase began during the presidency of former CIA Director George Herbert Walker Bush. Given the key role played by former U.S. Secretary of State Henry Kissinger as an overseer of this global operation, running U.S. foreign and strategic policy to serve British imperial interests, the subtitle given to the new edition of Dope, Inc. was The Book that Drove Kissinger Crazy.[[1]] LaRouche commissioned the book to provide an understanding of how the international drug trade functioned, including its connection to terrorism; its relationship to arms trafficking and creating insurgencies to undermine sovereign states; how its funds were deployed to impose puppet governments; to corrupt officials, using payments and blackmail; and increasingly how funds were spent to develop sophisticated surveillance technology in conjunction with leading Anglo-American-Israeli intelligence agencies. This is the world in which Jeffrey Epstein flourished, until he conveniently allegedly killed himself in prison. What is missing?

What is most intriguing in observing the nearly-non-stop media focus on Epstein is why so little attention was paid to how he became wealthy and positioned to develop connections with leaders of the political and financial establishment. What LaRouche insisted on in tracking a case like Epstein is, first, follow the money. Second, find the “British” angle—in the real world of dirty and suspicious strategic operations, there will always be a City of London connection. Third, and most important, discover the intent of those with the money and the connections—what is their goal?

In the case of Jeffrey Epstein, the first two points have been covered to some extent, though the reporting is sometimes sloppily done, or it treats events as things in themselves. But the “why” has been missing. In the overview which follows, we will establish that, whether he knew it or not—and most likely he did—Epstein was a deployed and protected asset of those City of London oligarchs and their American allies, who used him as part of their plan to establish a permanent, unassailable empire, which imposed a series of global “resets” in economic policy. The ultimate goal was, and remains, to establish a form of central banker’s dictatorship run by technocrats, with power over and above sovereign governments, while undermining the capability of citizens to defeat their intent.

The ‘Big Picture’

While the origins of this progression can be traced back to the end of World War II, LaRouche identified the period between the assassination of President Kennedy in November 1963 and the decision imposed on President Nixon and executed on August 15, 1971, to dismantle the post-war Bretton Woods system, as the beginning of the end for the American System of physical economy. Over the last more than five decades since then, there has been a steady erosion of real economic progress in the West, caused by a series of transitions to substitute financial, monetary valuations for physical goods production, as a measure of economic success. This shift, known broadly as “financialization,” measures economic success by the accrual of paper values resulting from the introduction of financial “innovation.” This has resulted in a boom-bust cycle of profit for those running it, but the monetary profit is fueled by increasing levels of uncollectible debt. When the inevitable bust occurs, the largest financial institutions are bailed out, as in the post-2008 popping of the mortgage-backed securities bubble, with more than $20 trillion going to bail out “Too Big To Fail” (TBTF) financial institutions, while millions of productive jobs disappeared, and between 5 and 7 million families lost their homes.[[2]]

This process has largely unfolded in three overlapping “transitions.” In what could be called Phase One, from August 15, 1971 to approximately 1987, with the introduction of a floating exchange-rate system, the shift from a physical economy to one of speculation stretched the limits of financing dependent on cash from depository institutions. Before 1971, most of the credit for businesses came from commercial banks. Increasingly, as demand for loans increased, the “credit” generated for takeovers, mergers and acquisitions, and leveraged buyouts—i.e., for speculative ventures—came from unconventional pools of liquidity. One of the largest sources of such funds was drug money laundered by organized crime networks, taking advantage of cracks in the regulatory system.

The characteristic of this period is best seen by looking at the practices of Michael Milken. He had access to billions of dollars of liquid cash from organized crime networks, such as those associated with the Bronfmans from Canada, and the Meyer Lansky network, which included Lucky Luciano, Max Fisher of Detroit, and other hoodlums who made fortunes as bootleggers during Prohibition, then tried to “go legit,” by laundering funds through banks, and other financial institutions.

Milken’s Monsters

One of those institutions was the investment bank Drexel Burnham Lambert. From his desk at Drexel Burnham, Milken pioneered channeling these funds into the purchase of high-risk, high-yield instruments appropriately dubbed “junk bonds,” to finance takeovers, carried out by “corporate raiders,” who used them to purchase targeted corporations through leveraged buyouts (LBOs), and mergers and acquisitions. Prominent among those identified as “Milken’s Monsters” by journalist Connie Bruck in her book Predator’s Ball[[3]] were Meshulam Riklis, Carl Lindner, Victor Posner, Laurence Tisch, Nelson Peltz, Saul Steinberg, Ronald Perelman, and Michael Steinhardt.[[4]] This flow of laundered money provided Milken with a large volume of cash which made his junk bond-fueled assault on corporate America virtually unstoppable. According to a report in the Washington Post, Milken was raising an average of $3 billion per week in junk bond sales in 1986. Milken made these funds available for takeovers which traditional banks rejected as taking on “too much risk”; junk bonds, by contrast, required relatively little equity for the trade. [See appendix]

The junk bond bubble peaked in 1988, with 215 LBOs that year, worth more than $35 billion. The largest was the RJR-Nabisco takeover, a $25 billion deal, completed in December 1988.

The apparent success of this method was later discovered to have been in part the result of criminal activity, including insider trading, false public reporting, tax fraud, collusion by rating agencies, and market manipulation. LBO takeovers funded by junk bonds fell off dramatically after 1988. Milken was hit with a 98-count indictment on March 30, 1988, and Drexel Burnham filed for bankruptcy in February 1990. Bruce Baird, a veteran criminal investigator of narcotics trafficking, who headed the task force under U.S. Attorney for the Southern District of New York Rudy Giuliani, which made the case against Milken, stated that he “was struck by the similarities between the insider trading investigations and mafia cases” he had worked on previously.

It should be noted that attorney Alan Dershowitz, who was a frequent guest at events sponsored by Epstein, argued in court on behalf of reducing Milken’s sentence, attacking his prosecution as “anti-Semitism”!

Further Financial Resets

Later, in what could be called Phase Two, there was a move to replace the physical limitations of laundering legally-questionable volumes of cash from junk bond sales, with a turn toward collateralized debt obligations (CDOs), with Drexel Burnham again in the lead. Combined with lax regulatory standards, CDOs became the next big thing, with mortgage-backed securities fueling a “recovery,” i.e., a housing bubble, which started to implode in 2007, and crashed in 2008. This “innovation” led to an explosion in derivative trading, which was initially related to agriculture futures trading; it took off in the next decades, aided by the Federal Reserve’s Quantitative Easing credit policy. Epstein began trading CDOs when employed at Bear Stearns.

Phase Three accelerated the shift towards overt fascism, where the line between government power and private finance is blurred or erased. The failure of the Dodd-Frank bill to regulate derivatives was supplemented by the increasing use of public-private partnerships (PPPs) after the 2008 crash. Initially promoted to increase funds available for infrastructure, a leading role was played by Felix Rohatyn from Lazard Freres. The shift from investment in physical infrastructure to government support for the emerging Silicon Valley tech sector naturally caught the interest of Epstein, who moved into this arena when he worked with Ehud Barak in raising funds for Israel’s tech center, and was expanded following his meeting with Peter Thiel and subsequent enthusiasm for AI.

Each of these phases went through boom-bust cycles; the boom cycle was hailed as a further advance in financing, while the inevitable bust led to costly bailouts of the speculative swindlers and pain for the shrinking number of workers involved in producing the physical goods needed to sustain the bubbles and bailouts.

Epstein and the ‘Deep State’

Epstein was introduced to this world when he left a teaching job at Manhattan’s Dalton School. After less than two years teaching, in 1976 he was hired by Bear Stearns, a Wall Street investment bank, where he worked first as an options trader, then as an advisor on tax mitigation strategies. He caught the eye of Bear’s CEO, Alan “Ace” Greenberg and was made a limited partner by 1980. Among the clients he worked with was Edgar Bronfman.

Despite his quick rise in the company, he was forced to leave under murky circumstances, rumored to have been a “regulatory problem,” in 1981. Epstein then set up a consulting firm, Intercontinental Assets Group (IAG), helping clients recover embezzled funds. By 1987, he was introduced to arms dealers and financial swindlers, which put him into play as an operative for leading international oligarchic circles. For example, in 1987, he met Doug Leese, a British arms dealer, who was part of the mid-1980s Al-Yamamah 40-billion-pound deal which sold British defense contractor BAE fighter jets to Saudi Arabia. (Leese was later knighted by the Queen.)

(The Al-Yamamah connection is notable in the broader picture. One of Epstein’s buddies was Britain’s Prince Andrew, who promoted British arms traffic, especially products of BAE, during his world travels. He recently had his title of “Prince” taken away, to protect the monarchy from association with the discredited Epstein.)

Among those he met through Leese was the notorious Adnan Khashoggi, with whom he established a business relationship involving arms trafficking. Khashoggi, who became a client of Epstein, was a key figure in the Iran-Contra scandal, which was exposed in the mid-1980s. It involved trading arms to Iran from Israel, in return for release of hostages held by Hezbollah in Lebanon. A portion of the proceeds from the sale was diverted secretly to the Contras in Nicaragua, to get around congressional legislation, the Boland Amendment, which limited aid to the Contras. The effort to overcome the legal restrictions was coordinated by Vice President George H.W. Bush, and involved top Reagan administration security and intelligence officials.

With the aid of Khashoggi, Epstein became involved with the bank used by the CIA and Khashoggi, the Bank of Credit and Commerce International (BCCI) to hide the financing of arms deals. According to former State Department official Mike Benz, Khashoggi had been working with the CIA for years, and told him that Epstein had been his “money bundler.”[[5]]

In 1987, Leese introduced Epstein to Steven Hoffenberg, the founder of Towers Financial Corporation, which specialized in debt collection. Hoffenberg hired him as a consultant for Towers. It crashed in 1994, when it was revealed to be running a ponzi scheme. More than $460 million was lost by more than 200,000 investors when it crashed. Among the failed schemes cooked up by Hoffenberg and Epstein was an attempted takeover of Pan Am Airways in 1987. Hoffenberg, who was a friend of Donald Trump and briefly the owner of the New York Post, spent more than eighteen years in prison for the Towers financial scam. He said the author of the ponzi scheme was Jeffrey Epstein.

Leslie Wexner and the Mob

Les Wexner met Jeffrey Epstein in 1986. Wexner had built an empire by selling high-turnover fashions through a series of retail stores, beginning with The Limited, which he opened in 1963. In 1978, he purchased a logistics firm, Mast Industries, which owned clothing factories producing cheap apparel in Asia. This was followed by a buying spree, which included both Lane Bryant and Victoria’s Secret in 1982. Given his emphasis on quick turnover of relatively inexpensive products, it’s not surprising that shopping centers were his preferred venue. As his retail operation expanded, he was dubbed the “Merlin of the Mall.”

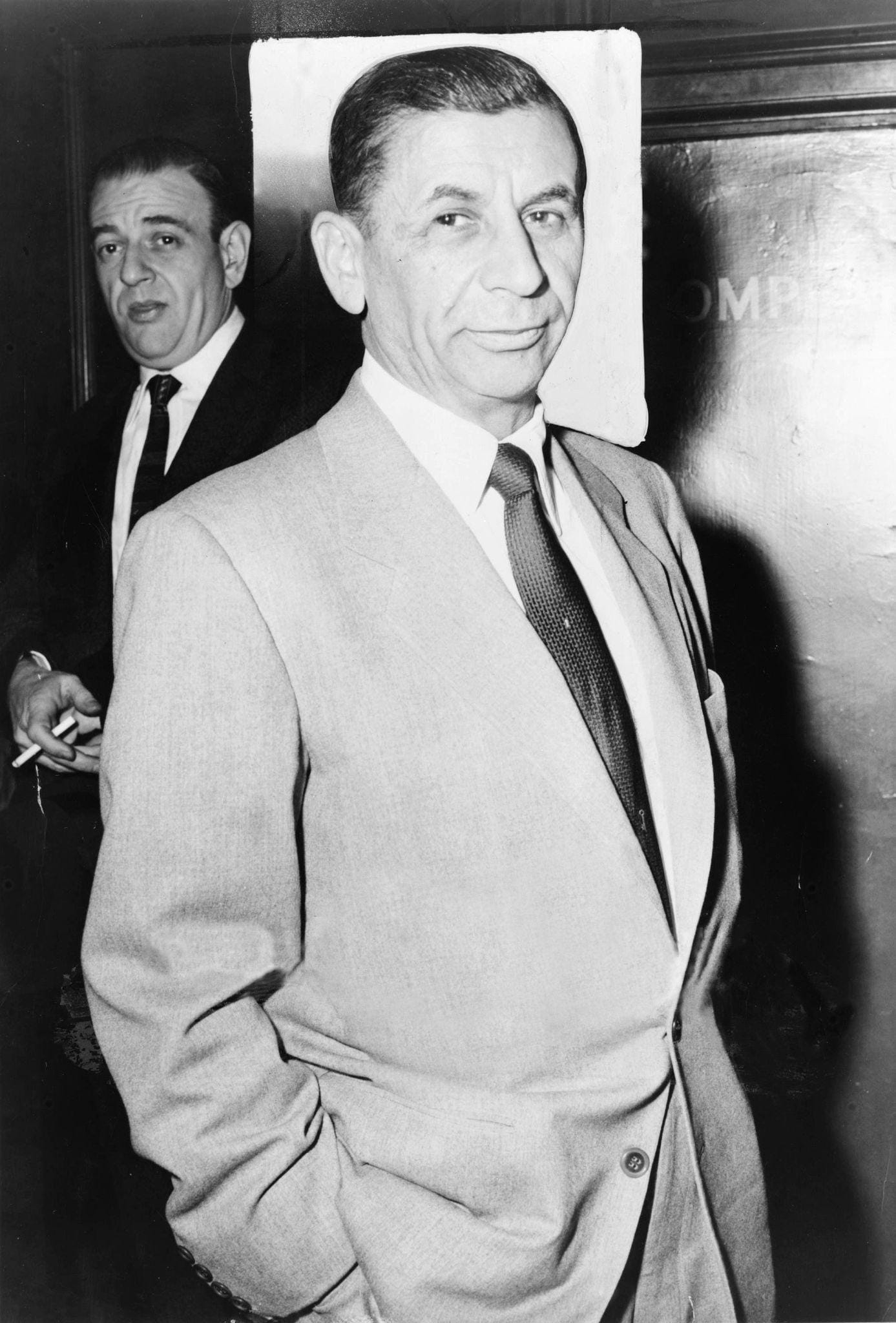

The suspicion that Wexner had backing from the mob was confirmed by his deal with Meshulam Riklis to buy Lerner Shops from him in 1984-85. Riklis, who founded the conglomerate Rapid-American Corp., was one of the first to use junk bonds in a takeover, buying Schenley Liquor in 1966 from Lewis Rosenstiel with $600 million raised through sales of junk bonds. Indicted for bootlegging in 1929—but never convicted—Rosenstiel worked closely with other bootleggers tied to the Lansky mob, such as Luciano, Moe Dalitz, Max Fisher, and “Longy” Zwillman. Some of the illegal booze they sold during Prohibition was moved through Canada by Sam Bronfman.

Riklis’s connection with the Lansky mob shaped his later career in “legitimate” business. His “creative” financing schemes and complex deals meant he could hide the source of laundered cash which funded his deals. Secondly, as a member of the “Jewish mob,” he was protected by the Anti-Defamation League (ADL), which smeared any law enforcement investigation into Jewish gangsters as stemming from anti-Semitism—the same false charge repeated against Lyndon LaRouche for his role in exposing Dope, Inc. as an operation run by the British monarchy, to protect the City of London drug traffickers (see The Ugly Truth About the ADL, published by EIR in December, 1992).

Third, Lansky and others were recruited during World War II into the Office of Naval Intelligence’s Operation Underworld, through which their skills at money laundering and arms trafficking were put to work in service of the Zionist movement, leading to Israel’s War of Independence. Lansky worked with Tibor Rosenbaum, a Haganah- and later Mossad-linked arms trafficker. Rosenbaum used the International Credit Bank of Geneva to launder funds for his operation, and for Lansky. Finally, these connections gave them an additional level of protection, due to their skills and practices which were useful to intelligence agencies. Lansky, for example, also coordinated with James Jesus Angleton, the long-time CIA counterintelligence chief; and Riklis had a long collaborative relationship with Israeli General and Prime Minister Ariel Sharon.

Wexner’s connection with Riklis put him in this circle. With gangster Sam Bronfman’s son Charles, he founded the Mega Group in 1991. Officially dedicated to Jewish philanthropy and education, it is part of the powerful Zionist Lobby in Washington. Other members of Mega were Ronald Lauder and hedge fund manager Michael Steinhardt.

As for the answer to the question, where did Epstein get the money which enabled him to spend freely to support his debauchery and future blackmail operations? The simple answer is, Wexner.

Wexner Anoints Epstein

Epstein’s career up to that point prepared him well for the doors opened by having access to Wexner’s fortune. Shortly after their first meeting, Epstein used what many called his charismatic personality, combined with his self-confidence, to win over Wexner. His skill set, developed as a self-described “bounty hunter” and a “money-mover” at Bear Stearns, led Wexner and others to believe he was a genius when it came to the mathematics of finance. Importantly, he learned from observing up close how the greed and arrogance of the Milken team led to their takedown. This enabled him to seamlessly move into the next phase of financialization, backed by a pool of funds, as Wexner’s personal financial advisor. It appears, from the spending to maintain his lavish lifestyle, he found ways to add to the amount provided to him by Wexner.

By July 1991, Wexner signed over power of attorney to Epstein, placing his personal fortune, then estimated at $1.8 billion, in Epstein’s hands. This gave him the right to hire people, sign checks, and borrow money, and buy and sell properties. For the next sixteen years, Epstein used his position to buy properties, including paying nearly $8 million to buy Little St. James Island in the U.S. Virgin Islands. In 1998, he is believed to have paid $20 million to purchase Wexner’s New York City mansion, followed by a $10 million purchase of a Boeing 727, which had belonged to The Limited, Wexner’s company.

And of course, there was money spent on travel, parties, and girls!

Though a financial “spreadsheet” has not yet been discovered, there are some clues to pursue. There is the record of direct transfer of funds paid to Epstein from Wexner, reliably put at more than $200 million by 2007. Among contacts found in his “black book” is financier Lewis Ranieri, from Salomon Brothers, a securitization expert known as the “father” of mortgage-backed securities. These were technically known as collateralized mortgage obligations (CMO), and allowed for a pooling of cash flow from different sources, such as mortgages and credit cards. Ranieri’s innovation subordinated the role of traditional private equity funding, which relied on institutional funding—i.e., from pension funds, insurance companies, and university endowments—to a more free-wheeling, less scrutinized flow of funds. This created an unsustainable bubble, which blew up with the 2007-08 financial crisis, leading to a bailout of the “Too Big To Fail” financial institutions. Those like Ranieri evaded accountability, and the bailout protected the big investors.

Epstein was directly involved in creating this bubble, through his firm Liquid Funding Limited, which was incorporated in Bermuda to evade taxes. Bear Stearns had a 40% stake in his company. From 2000 to 2007, Epstein used this firm to expand the debt accepted on the repurchase (repo) market, by creating securities from bundling of commercial mortgages and investment-grade residential mortgages as collateral, instead of using stocks and bonds. The rating agencies gave them the highest ratings, AAA, feeding the bubble.

This proved to be a bonanza for speculators, who launched a new boom in mergers and a bubble in the housing market, based on this “new” method for credit generation. The regulators, such as they were, allowed more multi-billion dollar deals. According to antitrust expert Matt Stoller, funds flowed from these new pools into these financial instruments, “without the police on the beat even paying attention.”

The 2008 Financial Blowout

When an overall poor underlying economy triggered growing defaults on mortgage payments, exposing the ratings as false, the securities collapsed, and a deep recession followed. By April 2007, each dollar invested in the collateralized debt bonds created by his company was highly leveraged, with $17 of borrowed funds. The two Bear Stearns funds which had partnered with Epstein lost more than $1.6 billion, which played a role in Bear Stearns collapse in March 2008. Six months later, in September 2008, Lehman Brothers investment bank was put into bankruptcy, and the “2008 Crash” was on.

Epstein was not a major figure in the subprime mortgage crisis, but an investigation was opened by the SEC’s Enforcement Division into his Financial Trust Company. Ultimately, his firm, Liquid Funding Limited, was reported to have paid $6.7 billion to settle claims, and was shut down in April 2008. Since the investigation by the SEC was a non-public, fact-finding inquiry, there was no report produced of its findings. (The liabilities of Liquid Funding were reported “paid-in-full” on May 1, 2018. The purchaser was J.P. Morgan Bank!)

As Bear Stearns was failing, Epstein, meanwhile, was preoccupied with a different investigation. As reported in Part One of this series, he was arrested in July 2006 by Palm Beach, Florida police on multiple counts of unlawful sex with minors, filed by the U.S. Attorney for South Florida Alex Acosta. At the same time, a separate, 53-page indictment was filed by the Assistant U.S. Attorney for Southern Florida, charging him with multiple counts of money laundering and running an unlicensed money-transmitting business. This second case was brushed aside by Acosta, who chose instead to accept a plea deal on two sexual counts, which resulted in a 13-month Club Fed-style sentence, which included daily leave from his prison cell so that he could continue to conduct his business! He began serving this sentence on June 30, 2008, just before the magnitude of the coming crash was known.

Thus, Epstein’s financial fraud was not tried in a Florida court. Acosta later claimed to have been unaware of the case developed against Epstein by his own Assistant U.S. Attorney!

A report by the International Consortium of Investigative Journalists released in July 2019, revealed that his Liquid Fund Company was an offshore “shell company” which was “loaded up with some of the financial products,” such as mortgage-backed securities and collateralized loan obligations “that would become synonymous with the financial excesses leading to the [2008] financial crisis.”[[6]]

Wexner Breaks with Epstein

It wasn’t until eighteen months after charges were brought against Epstein in June 2006 in Palm Beach County that Wexner took away the power of attorney he had given his former financial advisor. Why the delay? In a letter Wexner drafted in 2019, he wrote that he was “NEVER aware of the illegal activity charged in the indictment,” referring to filing of charges against Epstein in New York. In a speech he gave in September 2019, he said, “Being taken advantage of by someone who was so sick, so cunning, so depraved is something that I’m embarrassed that I was even close to.” And in a letter to his charitable foundation, he accused Epstein of having “misappropriated vast sums of money from me and my family.”[[7]]

Could Wexner, a billionaire who had been around the block a few times, have been that naïve? It strains credulity to accept that explanation. If anything, it raises the question as to whether Epstein, who had wall-to-wall video cameras in the living and work spaces he shared with Wexner, had compromising material to possibly blackmail him. As to whether or not Epstein was stealing from Wexner, there were red flags raised regarding Epstein’s many transactions while he was an advisor to Wexner. What is noteworthy was that the warnings came from the banks doing business with Epstein. JP Morgan tracked nearly 5,000 transactions by Epstein adding up to more than $1 billion done through their bank. In investigating this, The New York Times said JP Morgan’s internal reports asked whether these were related to “sex trafficking,” or for “possibly other illegal activity.”

At the moment, the suspicions of other types of criminal activity remain unproven, but highly suggestive. This is especially true, given the criminal nature of the parties involved in the laundering of huge volumes of money deployed outside proper regulation, and able to run circles around a compromised regulatory process under attack financed by those—such as second and third generations of associates of the Bronfman family, the Lansky gang, Max Fisher’s Detroit-based Purple Gang, etc.—who benefitted from their efforts. Major banks, including JP Morgan and Deutsche Bank, reached settlements in some cases related to Epstein, and adjudication is pending in lawsuits against the Bank of America and BNY Mellon.

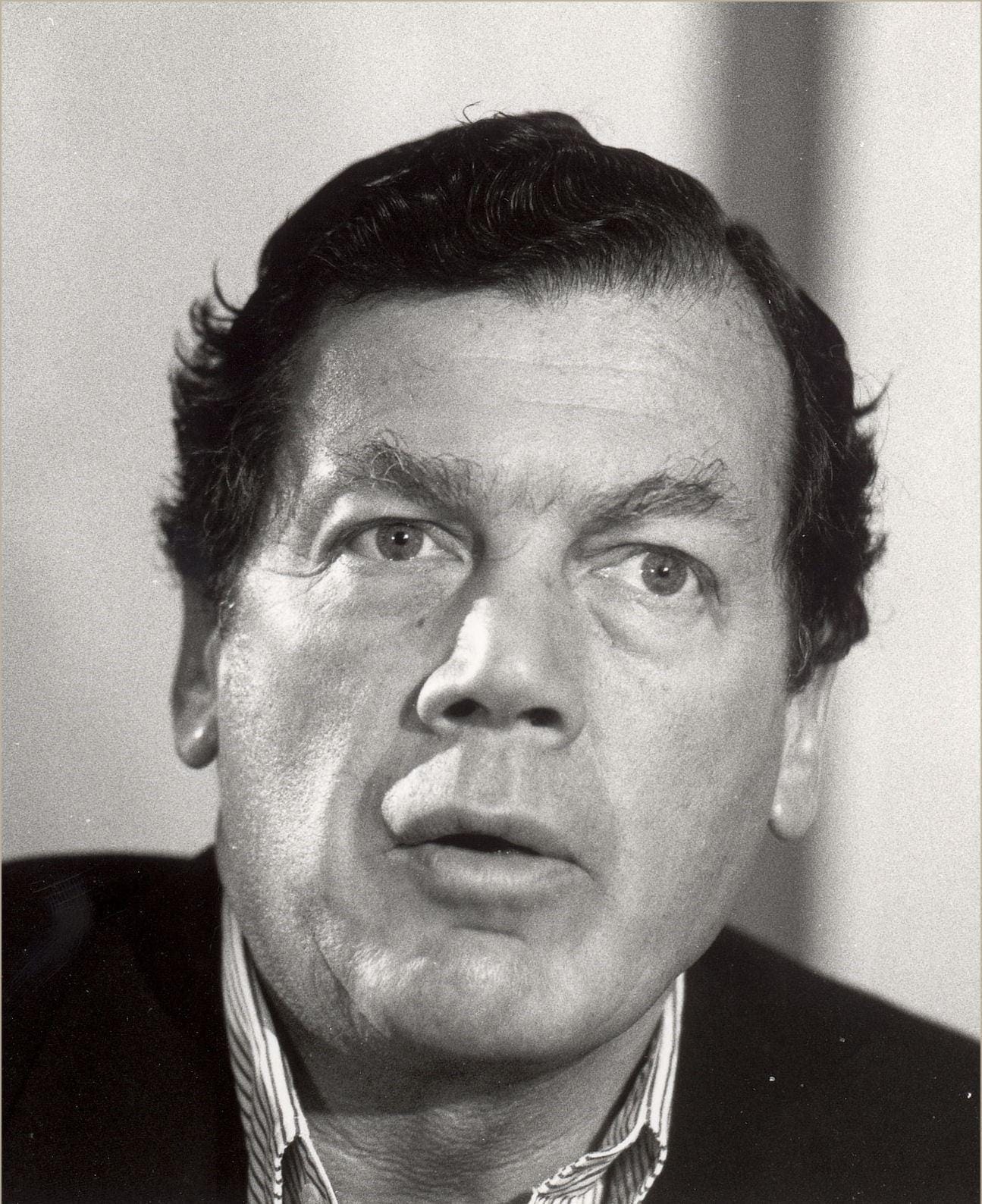

Milken 2.0

Emails released in recent days shed light on Epstein’s activities after he completed his 13-month prison sentence in a Palm Beach County prison in July 2009. No longer bankrolled by Wexner, he soon found another patron, Leon Black, whom he had first met in 2000 at a party at Mar-a-Lago. By 2012, Epstein was working for Leon Black, who made a fortune at Drexel Burnham, selling junk bonds for Michael Milken, then as head of Milken’s Mergers and Acquisitions department. When Drexel was shut down, he founded Apollo Global Management, where he built its portfolio up to manage $400 billion in assets. From 2012 to 2017, he paid Epstein $158 million in fees, provided a $30 million loan, and donated $10 million to Epstein’s charity.[[8]]

What did Epstein do for Black, to justify payments of more than $200 million in five years? In July 2019, after the charges against Epstein were filed in New York, Black sent an email to Apollo employees stating that Epstein provided “professional services to my family partnership and related family entities, involving tax, estate planning and philanthropic advice,” denying any wrongdoing. Later, Black acknowledged that he had worked closely with Epstein, expressing regrets for “having any involvement with [Epstein].”

It is anticipated that it will require another 10 years of legal actions against Black before the magnitude of the damage done by his involvement with Epstein is known.

But thanks to the flood of emails, the picture of Epstein’s activity, during his time with Black and after, show his continued personal moral depravity, regarding his abuse of young girls and women, and through his financial and business dealings. Efforts are ongoing to provide compensation to those girls and women who were victims of sexual abuse by Epstein, his “partner” Ghislaine Maxwell, and their rich and famous debauched co-participants. As of September 2023, payments to 135 identifiable Epstein victims totaled approximately $154 million.

Another Financial Reset

While Epstein lost a few of his friends after the Florida plea deal, many remained on good terms with him upon his release, and he pursued new allies in his drive to remain relevant in the shifting world of corporate finance. He became active as a venture capitalist, seeking opportunities to find a niche in the public-private landscape funding the tech world, and artificial intelligence (AI) startups, after the 2008 Crash. Early in 2015, he was introduced to Peter Thiel, one of the leaders in this milieu, by Reid Hoffman, a member of Thiel’s PayPal mafia. Hoffman founded LinkedIn after PayPal was sold to eBay in 2002.[[9]] Hoffman is the co-author of the influential New York Times bestseller, The Startup of You, which is promoted as the manual “that taught a generation how to transform their careers.”

As the public-private partnership model was expanding its role in the new paradigm of AI and Tech, Epstein was singing from the same page. He fully joined the libertarian chorus, arguing for less regulation of Tech companies, a move to a cryptocurrency financial system, further weakening of antitrust laws, and reducing the power of government. At the same time, he became an advocate for “cross-disciplinary studies,” such as that being run by the MIT Media Lab “to explore and develop transformative technologies.” He helped convince Microsoft’s Bill Gates to contribute $2 million to the project, and Leon Black to invest $5.5 million, helping to feed the AI/Tech bubble.

Epstein was betting that this next economic shift would be dominated by the collection of metadata, and the use of information technology to control the thinking of the vast majority of the population, such that its application could be used to accurately predict the future, by limiting options. Thiel’s Palantir company is on the cutting edge of both advances in “soft power,” i.e., hybrid warfare, as well as working to better guide the destructive power of kinetic warfare.

For that reason, after this introduction to Thiel, Epstein invested $40 million in Thiel’s startup fund Valar Ventures. Founded in 2010 by Thiel and two others, it invested the bulk of its funds in Tech startups outside Silicon Valley, including in Europe, the UK, and Canada. In addition to his $40 million investment, Epstein brought his relationship with former Israeli Prime Minister Ehud Barak into collaboration. Epstein introduced Barak to Thiel, apparently in June 2015, seeking funds to invest in an Israeli startup, Reporty, later renamed Carbyne, which sells emergency communication technologies. Other joint projects from the collaboration with Barak involve surveillance technology and data collection.

Epilogue

This last period of Epstein’s life was cut short by his arrest and suicide—if it was a suicide. There is still much to investigate, including his connections with the U.S. intelligence agencies—notably the CIA, Britain’s MI6, and Israel’s Mossad. For the latter three agencies, his connection to Robert Maxwell suggests there is much more to discover, as Maxwell served all three.

Maxwell

Epstein’s “Maxwell connection” cannot have been accidental. Epstein first met Ghislaine Maxwell in 1991, shortly after her father’s death. She soon became a regular companion of his, and is now serving a 20-year jail term following her conviction for grooming and sex trafficking young girls for Epstein. There are rumors that she enlisted Epstein’s help to hide 460 million pounds her father stole from the pension funds of his newspaper’s employees, plus another 300 million otherwise embezzled from the firm. Only 100 million was ever recovered. Hiding funds for wealthy clients had been part of his expertise as an account manager. The BBC made a three-part series, The House of Maxwell, based on this premise, but the money has not been found.

A parallel between Epstein and Maxwell is their relationship with Israeli intelligence. Maxwell had regular contacts with the Mossad, often on behalf of Britain’s MI6 and the Soviet KGB. Epstein, between 2013 and 2016, had numerous meetings with former Prime Minister Ehud Barak, mostly related to sharing U.S. military and surveillance technology. In addition to his role in making a connection between Barak and Peter Thiel, he provided contacts for Google’s Larry Page and Sergey Brin, and Microsoft’s Bill Gates. As with Barak, the others were frequent guests at Epstein’s dinners and parties. In building up Israel’s high-tech military and security forces, he is following the course of the hard-core Zionists of the Lansky mob, who used money from drug- and weapons-trafficking and prostitution to attempt to realize their dream of a Greater Israel, cleansed of Palestinians.

As this report is being written, the daily release of emails confirms two basic truths about the Epstein saga: He had his hands on virtually everything related to “financial innovation,” using the funds provided to him to serve the Deep State; and secondly, he was protected by those whose interests he served.

There is one other deeper truth—those who worked with him knew of his debased morals. In many cases, they shared his lack of moral decency.

There is one final question not yet answered, which is why did President Trump turn against his allies, such as Tucker Carlson, Candace Owens, Rep. Marjorie Taylor Green, and a portion of his most steadfast supporters in the MAGA movement, when they demanded that he release all the files? They believed he would keep his word, and expose the corruption of the military-industrial complex and hold them accountable. They also believed him when he said he would defend the people from the parasitical greed of the financial system, and Make America Great Again.

As I am completing this article, the President has reversed himself again, now saying he wants everything out in the open. The issue here must not be a political initiative to get revenge against his enemies, such as Bill Clinton, Bill Gates, Larry Summers or others who participated in Epstein’s “salons,” but to defend justice and fairness, and to shed light on what we allowed to go so terribly wrong.

To Be Continued…

Appendix: The Net Effect of Milken’s Corporate Financing Revolution

The brief but intoxicating experience of the Milken-driven takeovers was hailed as a revival of free market policies, and conservatives and libertarians rallied support for the Milken revolution. They preached that corporate raiders were unleashing the raw potential of American capitalism, by “democratizing markets,” challenging “entrenched interests,” and “levelling the playing field,” while creating new businesses.

One leading promoter of what was called supply-side economics, George Gilder, praised Milken as leading the way in freeing “vast sums trapped in old-line businesses and put[ting] them back into the markets.” The supply-siders led the charge for tax cuts, budget cuts, and deregulation, with one major goal being the repeal of Franklin Roosevelt’s Depression-era Glass-Steagall bank regulation act, which put a wall of separation between commercial banks and savings banks. Glass-Steagall was repealed by a bipartisan vote in Congress in 1999, which was signed into law by President Bill Clinton, opening the way to hyperinflated costs for housing, financed by mortgage-backed securities.

Rather than revitalizing capitalism, the net effect of the Milken era was to provide billions of dollars in fees for the raiders and takeover firms such as Kohlberg, Kravis and Roberts. They skirted the poorly-enforced regulations, bilking both the shareholders who trusted them and the U.S. government through tax fraud. They looted pension funds, which had been protected, risking them on hostile takeovers, while illegally skimming cash off the top. The corporations they targeted were left with billions of dollars in new, largely uncollectible debt, and led to a steep fall-off of investment in R&D, costing millions of jobs, and shutting down many older American industrial towns.

The chief benefactors of the “Milken revolution,” the “new entrepreneurs,” included criminals like Meshulam Riklis, Victor Posner, and Carl Lindner, who maintained close ties to the remnants of the organized crime networks of Meyer Lansky, whose ill-gotten gains were seed capital for Milken’s money laundering. As reported by Connie Bruck, they gathered annually in fancy venues for what they snidely referred to as the “Predator’s Ball.” Nelson Peltz, who was one of them, quipped about the debt they generated to line their own pockets, “Never have so few owed so much to so many.”

Among this network were two billionaires, Les Wexner and Leon Black, who used the wealth created by Milken’s Monsters to finance Jeffrey Epstein.

[[1]]: Dope, Inc.: The Book That Drove Henry Kissinger Crazy: Washington, D.C., Executive Intelligence Review, 1992. Kissinger acknowledged his subservience to British intelligence in his May 10, 1982 address at the Royal Institute of International Affairs/Chatham House, where he admitted that he often briefed the British before his own staff: “In my period in office, the British played a seminal part in certain American bilateral negotiations with the Soviet Union…. In my White House incarnation then, I kept the British Foreign Office better informed and more closely engaged than I did the American State Department.” (For more details, see “Kissinger’s Public Confession as an Agent of British Influence.”)

[[2]]: For a summary of the creation, blowout and bailout of “Too Big To Fail” banks in the post-2007-08 crash, see “The Evils of Monetarism: It's ‘Globalization,’ Stupid!”

[[3]]: The name was given to them by one of the first who used such funds for takeovers, Meshulam Riklis. For a review of how “junk bonds” and LBOs funded by organized crime became normalized Wall Street practice, see two articles published by EIR on “Milken’s Monsters” by Harley Schlanger: “ ‘Milken's Monsters’ and the Junk Bond Debacle” and “Myth of Milken as ‘Outsider’ Inside Trader Is Shattered.”

[[4]]: Michael Steinhardt’s connection to organized crime is more defined than some of the others, as he was open about it. According to Forbes magazine, Steinhardt built his hedge fund from envelopes of cash provided by his father, “Red” Steinhardt, who served as a “fence” to unload goods stolen by Lansky, Lucky Luciano, Frank Costello, and Bugsy Siegel. (Forbes, Nov. 8, 2001, “Michael Steinhardt’s Voyage Around His Father.”)

[[5]]: Mike Benz interview with Jesse Kelly. Benz, a former State Department official, is the executive director, Foundation for Freedom Online.

[[6]]: Quotes from a July 18, 2019 release of the International Consortium of Investigative Journalists, “Jeffrey Epstein’s Offshore Fortune Traced to Paradise Papers.”

[[7]]: Quotes from Vanity Fair, July-August 2021, “The Mogul and the Monster: Inside Jeffrey Epstein’s Decades-Long Relationship With His Biggest Client,” by Gabriel Sherman.

[[8]]: A brief note on Black’s family background is interesting. His father, Eli Black, took over United Fruit Co. in 1969, changing its name to United Brands. Black died from suicide in 1975. During Leon’s time as CEO, the company continued its involvement in drug trafficking, in partnership with drug cartels, transporting cocaine on its ships through the 1990s.

[[9]]: Associates of the “PayPal mafia” include Thiel, Hoffman, Elon Musk and a dozen others, who were at the forefront of the move of Silicon Valley Tech firms into the military-industrial complex. Thiel’s Founder’s Fund funded firms such as SpaceX with Musk and Airbnb.