Preamble:

Why this Action is Urgently Necessary

The trans-Atlantic financial system is today poised for a systemic, tectonic collapse driven by a $2 quadrillion speculative bubble of unpayable derivatives and other financial obligations. Leading American economist Lyndon LaRouche warned in the spring of 1971 that this day would arrive if we did not reverse President Richard Nixon’s takedown of the Bretton Woods fixed-exchange-rate system, executed under pressure from the City of London and Wall Street’s George Schultz.

We did not make those changes, and now mankind urgently needs an entirely new international security and development architecture if we are to solve any of the individual crises spawned by the systemic breakdown crisis. That new paradigm, of which the proposed policies outlined below are a part, must rest on a solid foundation of principles, such as those presented in Helga Zepp-LaRouche’s “Ten Principles” and global economic policies outlined by Lyndon LaRouche in his “Four Laws.”

The draft legislation and memorial resolution which follow, represent immediate actions which can be taken by American lawmakers to protect the American people from the devastation of a chaotic meltdown, and create the conditions which would allow the United States to join with her European partners, as well as nations of the BRICS-Plus, to put the entire global system through an orderly bankruptcy reorganization, and return to an international fixed-exchange-rate system, which will allow for long-term investments into physical infrastructure and production necessary to sustain a growing population with a rising standard of living.

Preface

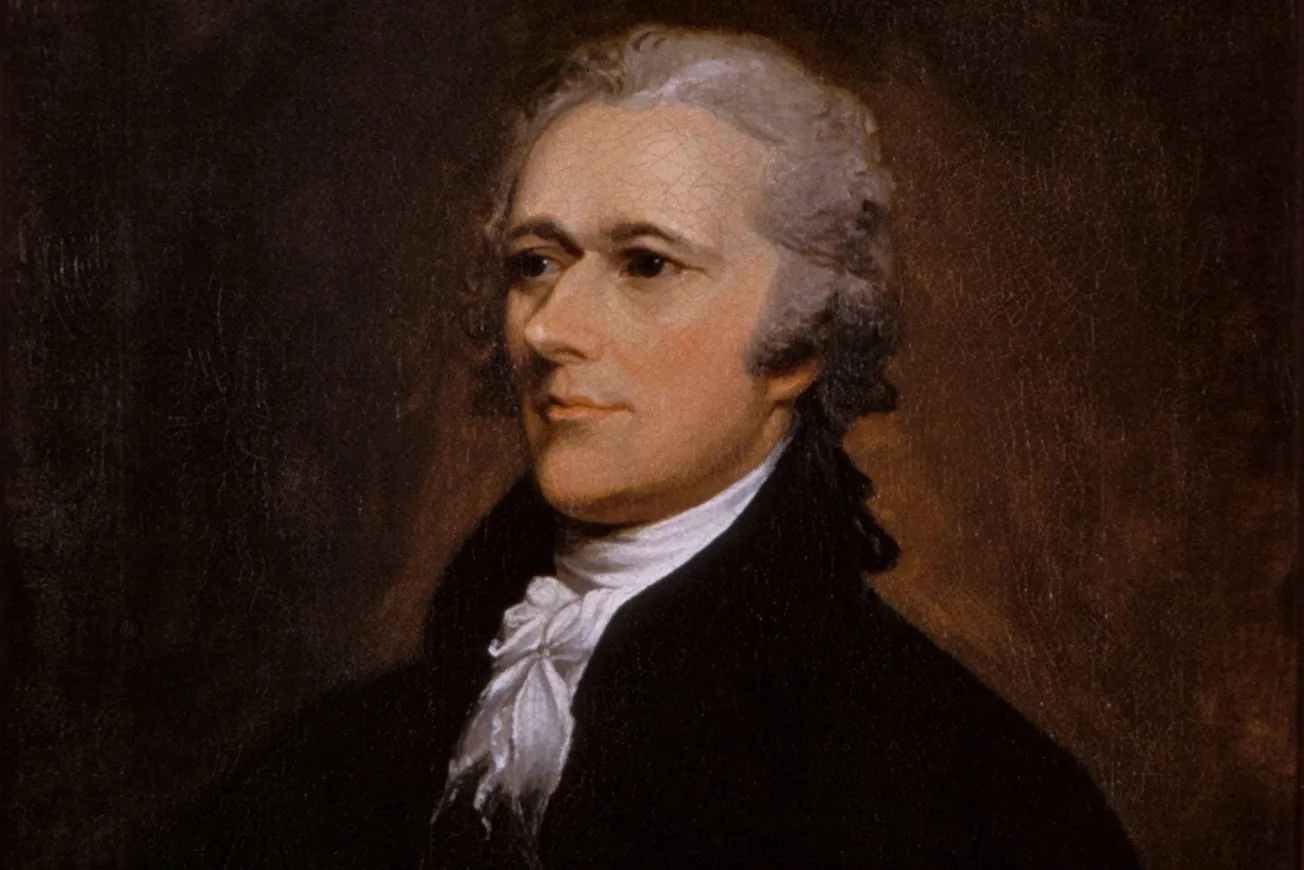

To promote the General Welfare, let America on its semiquincentennial birthday choose the American System of economy—the public credit system of Treasury Secretary Alexander Hamilton, from his 1791 Report on the Public Credit and other reports to Congress—over a system of financial speculations and crises.

In order to secure, for ourselves and our posterity, the blessings of freedom from colonialism, and of free and sovereign nations’ peaceful cooperation, the United States moreover wants its own economic progress to be complemented by similar progress and development of partner nations, including developing nations.

A. Bank Separation

Enact a general bank-separation policy. Its purpose is to separate commercial deposit-and-loan banking, from investment banking, merchant banking, and speculation in debt securities: as this bank separation was accomplished in President Madison’s U.S. Bank Charter Act of 1816, which rechartered the U.S. National Bank; in President Lincoln’s Banking Acts of 1863 and 1864 during the U.S. Civil War, which created the first system of nationally chartered banks; in President Franklin Roosevelt’s Glass-Steagall Banking Act of 1933, which began the recovery from the Great Depression; and in the Bank Holding Company Act of 1957; as well in as banking acts modeled on Glass-Steagall in several major European nations after World War II.

1. Reorganization of the Commercial Banks

From the 2007-08 global financial crash until the early 2020s, the loans-to-deposits ratio in the United States banking system as a whole went from 100% to 60%; and in the biggest six “Wall Street” megabanks, from approximately 85% to approximately 40%. The rest is speculative investment, including these banks’ ownership of, and prime broker services to, thousands of hedge funds, money-market mutual funds, etc.

Glass-Steagall will prohibit this. The banks will have a congressionally determined period of six months, during which to sell off or separate all speculative securities divisions (of which the largest banks each have several thousand), leaving those entities with no prospect of Federal government, Federal Deposit Insurance Corporation, or Federal Reserve bailout when they fail.

2. Separation from Securities Broker-Dealing

Commercial banks, no matter how large, will be limited to the business of depositary services and lending, as well as services incidental to commercial banking such as currency exchange, or purchase and redemption of government securities for customers. They will specifically be prohibited both from owning, and from lending to funds for the purpose of securities broker-dealing; and from dealing in the markets for financial derivatives contracts.

3. Bankruptcy Reorganization

With the growing mass of speculative instruments—derivatives, crypto coins, etc.—threatening to produce an uncontrolled meltdown of the global and U.S. financial system, and to ignite an agro-industrial collapse greater than that of 1929-33, it is necessary for the government to institute an orderly bankruptcy reorganization of what are now over $2 quadrillion in financial assets globally. The productive assets on the books of financial institutions—loans to manufacturing, agriculture, infrastructure, home and car purchases, pensions, and other federal and local government programs serving the general welfare—will be protected and nourished. The federal government will financially backstop workers’ pensions and similar obligations, to prevent them from incurring losses. The assets of the highly dangerous speculative class, given the crisis, will be immediately, massively written down, and wiped off financial institutions’ books.

4. Holding Companies

Commercial bank holding companies, which own commercial banks, will be prohibited from owning investment banks, or from owning commodities dealers which hold and speculate in primary commodities essential to the economy, including energy and electricity, as under the 1957 Bank Holding Companies Act.

5. Providing Credit

The dismal ratio of loans to deposits in the big banks is directly connected to the Federal Reserve Bank—a central bank which lends to no one, while pumping deposits into those megabanks, making them 50% larger since the 2008 crash. Those banks, in turn, use the deposits to speculate rather than lend.

Therefore, a reinstated Glass-Steagall Act, which dries out that mass of speculative debt bubbles dominating the banks, sets the stage for real economic recovery. The economy needs credit for infrastructure projects, reindustrialization, and to participate in economic development abroad

B. National Banking, Capital Budget

Enact a capital budget for Industrialization and economic infrastructure, a budget which is loaned as credit and therefore far more generous than what can be spent by Treasury. This was specified under the National Bank Acts in 1791, 1816, and 1841; by the Reconstruction Finance Corporation from 1932-1955 on a large and effective scale; and since 2018 (but on a very small scale) by the United States International Development Finance Corporation.

Let Congress charter a national bank within the Federal Reserve Bank, taking control of the credit and monetary functions and responsibilities of the Federal Reserve and implementing a policy of development lending for economic infrastructure and industrialization, both domestically and through international development cooperation.

1. Purposes

To Create a Bank of the United States for Infrastructure and Manufacturing

Under restored Glass-Steagall regulation, the establishment of a Bank of the United States, operating as a commercial bank, will restore the valid profit to the commercial banking system which arises from manufacturing, industry, increasing productivity of lands and soils, and the building of new, technologically advanced infrastructure which promotes these.

It is a purpose of the United States Congress in creating a third Bank of the United States, to return to the level of progress of the United States’ “golden age of productivity,” 1935-65, when multifactor productivity advanced by 3-4% annually.

Treasury Secretary Alexander Hamilton was correct in finding that a public debt is a public blessing when directed through a public bank into advancements in the productive power of the nation’s economy.

2. Principles

By this legislation, the Congress authorizes the creation of a public corporation to be called the Bank of the United States, which is authorized to: provide credit for major national projects of infrastructure, including surface transportation and ports, national intercity electrified rail transport, water management and supply, drought prevention, flood prevention and storm protection, electrical energy production and distribution, and in particular supporting space exploration and the development of nuclear fusion technologies; make loans to agencies of the United States authorized for such projects; enter joint ventures with agencies of other nations mutually to provide credit for major international projects of new infrastructure and growth; provide credit to state and municipal capital projects by purchase of municipal bonds as issued; discount bank loans to businesses participating in such projects; and cooperate with the United States Export-Import Bank to provide trade credits to businesses engaged in international infrastructure projects.

Capitalization

(a) The Bank of the United States will be capitalized up to a maximum of $2 trillion by issuing preferred shares in exchange for

- publicly held Treasury securities of three (3) years or greater maturity, and

- outstanding municipal bonds of Federal states or cities of five (5) years or greater maturity. The Federal Reserve Bank will assist this capitalization by continuing to sell its holdings of Treasury securities.

(b) The Treasury shall be an on-call subscriber to the Bank in an amount up to $100 billion in new issues of thirty (30)-year U.S. Treasury bonds, and shall receive the same preferred shares in exchange.

(c) The Bank shall be authorized to retain U.S. government revenue deposits. It shall receive the proceeds of the federal tax on gasoline and diesel fuel (the National Transportation Trust Fund), to the extent the Bank assumes the transportation infrastructure responsibilities of the Trust Fund, as a fund with which to pay the interest on its preferred stock.

(d) The Bank shall receive into its circulating deposits, regular interest payments from state and municipal agencies whose bonds have been subscribed by their holders as capital in the Bank.

(e) State and municipal agencies which receive capital project support through purchase by the Bank of municipal capital bonds, shall be required to keep on deposit at the Bank, five (5) percent of the proceeds of such bond purchases, until needed for completion of the project involved.

(f) The Bank shall be authorized further to raise borrowed capital for its project investments from the public, from commercial banks and business corporations, and from investment funds, by issuing additional debenture bonds up to a total not greater than its subscribed capital.

(g) Subscribers to the capital of the Bank who are not U.S. citizens or U.S.-based institutions shall be non-voting shareholders.

Commercial Bank Lending

(a) The Bank of the United States shall discount loans, made by commercial banks operating under Glass-Steagall standards of regulation, to participants in approved projects of economic infrastructure. The rate of discounting of loans shall be determined by the Bank’s Board of Directors, but shall not be less than 50%.

(b) The Bank may join in new loans for approved projects in cooperation with other lending institutions, including multinational and national development banks in other nations, participating in such loans by up to 50%.

(c) The majority of loans and discounts made by the Bank should coincide in maturities with the time periods of anticipated profitability and projected useful life of the projects and new facilities financed with such loans and discounts.

(d) The Bank may make loans to companies involved in manufacturing for such companies’ additional needs of capital expansion, where those companies can show that the additional capital cannot be obtained from local or regional private commercial banks.

Management

(a) Directors of the Bank shall have a majority actively engaged in industrial or engineering activity or have had at least 15 years’ experience in industry, infrastructure, and agriculture, to include representatives from the United States Army Corps of Engineers and representatives from the National Aeronautics and Space Administration and aerospace industry. The Board of Directors shall elect a president and assemble a staff with experience in the commercial banking, engineering, heavy construction, and scientific fields.

(b) This management shall replace the Board of Governors of the Federal Reserve, with the exception of the Governor for Bank Supervision.

Resolution

For Glass-Steagall and a National Bank

WHEREAS the public credit system designed and carried out by Treasury Secretary Alexander Hamilton laid the basis for America’s once-unparalleled industrial power; and,

WHEREAS the founding policy of this nation was one of non-interference, and cooperation in progress with all sovereign republics, as stated most forcefully by President Monroe’s Secretary of State and successor in the White House, John Quincy Adams; and,

WHEREAS the combination of commercial (deposit and lending) banks, with a national bank or national banking system, once effectively created a credit system to suppress the dangerous powers of financial speculation, as most recently by President Franklin Roosevelt’s Glass-Steagall U.S. Banking separation Act of 1933 together with the Reconstruction Finance Corporation; and,

WHEREAS the end of Glass-Steagall in the 1990s allowed an explosion of speculation in financial derivatives contracts and led to the global financial crisis of 2007-08; and,

WHEREAS the U.S.—and world—financial system is on the verge of an explosive uncontrolled collapse because of the growth of more than $2.0 quadrillion in derivatives, crypto currencies, as well as commercial banking, hedge fund, and private equity speculation, which collapse will further destroy the financial system, agro-industrial enterprises, and productive employment; and,

WHEREAS to protect it, the financial system should be placed into an orderly bankruptcy reorganization, and the vast majority of these speculative instruments wiped from the books of financial and business organizations, and that this be done as a coordinated aspect of Glass-Steagall bank separation; and,

WHEREAS after that global financial crisis, speculation ruled the banking system, with the ratio of loans to deposits in the U.S. banking system falling from its long-term level of approximately 100% down to 60% by 2022, and in the biggest Wall Street banks from 85% down to approximately 40%; and,

WHEREAS under Glass-Steagall bank separation, commercial banks are essentially limited to the business of depositary services and lending, and prohibited both from owning, and from lending to funds for the purpose of securities broker-dealing; and from dealing in the markets for financial derivatives contracts; and,

WHEREAS the Federal Reserve feeds speculation rather than lending by commercial bank holding companies, in that it purchases megabanks’ securities in exchange for electronic reserves, facilitating further securities dealing by those banks; and,

WHEREAS the Federal Reserve itself, with unlimited liquidity, does no lending at all except to these megabanks; and,

WHEREAS the economy, in order to recover its powers of industrialization and technological advance, needs credit for infrastructure projects, reindustrialization, and to participate in economic development projects abroad; and,

WHEREAS a national bank can accomplish this by credit issued through a capital budget, enabling far more funding than can be accomplished by federal spending;

THEREFORE:

We, ______________________________________________________________,

support the rechartering of the Federal Reserve as a Bank of the United States for infrastructure and manufactures; and support the re-enactment of a Glass-Steagall bank separation act to dry out massive debt speculations by banks and “private credit,” and prepare the way for the return to a credit system.