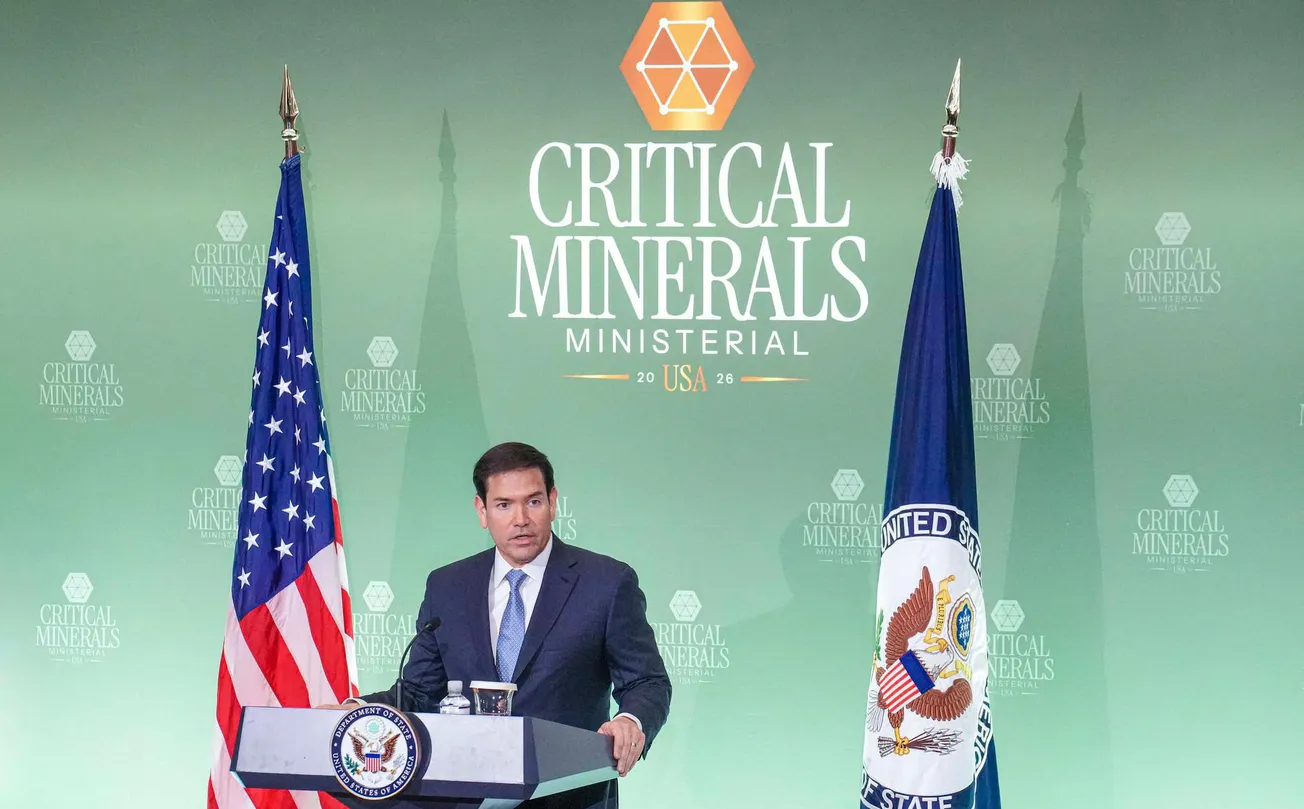

After what was reportedly two months of intense preparation, which also involved U.S. Treasury Secretary Scott Bessent, Secretary of State Marco Rubio hosted the Critical Minerals Ministerial Feb. 4 at the State Department to sell the idea that the U.S. will be able to form an alliance of like-minded nations that will control supply chains of critical minerals, including rare earths, and vastly reduce China’s “dominance” of the market. Not one U.S. official mentioned China by name, however, speaking before the audience of representatives of 55 nations, made up largely of foreign ministers, diplomats, and private sector companies. But the intent of the conference was clear. The announced plan is to create a U.S.-led trading bloc and wrest control of critical minerals supply chains from China’s control by, among other things, throwing a lot of money around.

Even before the Feb. 4 conference, on Monday, Feb. 2, U.S. President Donald Trump announced the launching of a strategic minerals stockpile for the U.S. named “Project Vault.” This will be funded by $2 billion of private capital and a $10 billion loan from the U.S. Export-Import Bank. According to Bloomberg, the U.S. is also committing to an additional $100 billion lending authority on top of the $12 billion stockpile.

In his keynote speech on Feb. 4, U.S. Vice President JD Vance announced the creation of the “Forum on Resource Geostrategic Engagement” (FORGE), to address the critical minerals market, which he said is “failing because of erratic and unpredictable prices” and lack of investment. FORGE, Vance said, will establish “reference prices” for critical minerals at each stage of production, reflecting “real-world fair market value.” Vance explained that these prices will act as a floor using adjustable tariffs, preventing some (obviously Chinese) companies from “flooding the market with cheap minerals that undercut U.S. miners and processors.” Vance assured his audience that the preferential trade zone the U.S. is creating for critical minerals, will protect them from external disruptions—presumably from China—through “enforceable price floors.”