“The ‘Anti-Trump’ Numbers Man Who May Force the U.K. To Take a Side” is the headline of a BBC article March 10, based on an interview by “Economics Editor Faisal Islam.” They don’t note it, but Carney has been, and presumably still is, extremely close to King Charles—Zelenskyy’s recent champion—whose “climate acolyte” he was, in addition to being unrivaled in power among central bankers, with the possible exception of Italy’s Mario Draghi.

This quote from the interview/article by BBC is significant: “Carney believes that Trump only respects power. Of any attempt to mollify Trump, he said ‘good luck with that.’ He will focus further tariff retaliation on bringing inflation and interest rate rises to Canada’s ‘southern neighbour.’” And he wants to coordinate this financial war with the U.K. “Canada’s new leadership expects support from its Commonwealth ally, the U.K. After my recent interview with him, Carney turned the camera to the portrait on the wall of the office from which he was talking to me: King Charles. The message was clear. Canada and the U.K. should be on the same side in this new world era.”

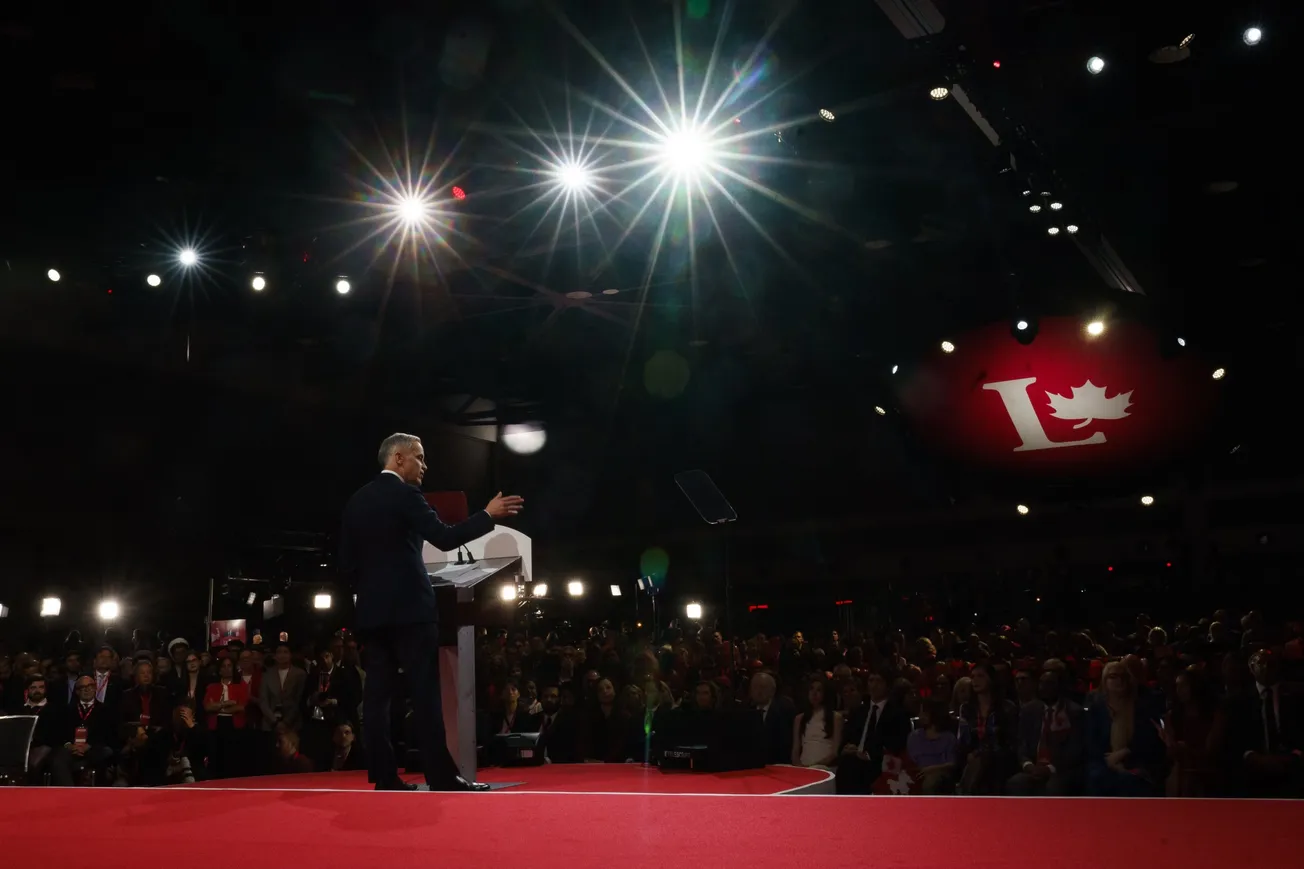

Carney’s Liberal Party acceptance speech March 9 for his candidacy to replace Justin Trudeau as Prime Minister was politically in line with the European Commission’s Ursula von der Leyen, and other hardline anti-U.S. synarchists from Europe. “In trade as in hawkey (his pronunciation), we will win.” Canada’s tariffs will stay “until we are treated with respect.” “We cannot let him (Trump) win.” “Dark days brought on by a country we can no longer trust,” etc.

As long ago as August 2019 at Jackson Hole, Wyoming, Carney gave the keynote speech about “replacing the dollar with a global digital currency managed by central banks.” Carney’s Global Financial Alliance for the Net Zero “climate change” financial scam, for which he and others claimed hundreds of trillions of dollars ready to boycott fossil fuel investments, has largely fallen apart, with numerous of the biggest banks and other players leaving it. His Brookfield Asset Management firm, a big one (though not on BlackRock’s scale), is “under scrutiny” as Financial Times put it in an article reprinted in Financial Post on March 9, for being a kind of curious variation on a Ponzi scheme. BAM repeatedly buys real estate assets from itself, using various corporate divisions and shells, and books “earnings” from these sales, which go into its portfolio. This is called “circular capital management.” Its international real estate portfolio, otherwise, is losing money, according to FT, which calls BAM’s financial workings “extremely complex.”

Carney was also Goldman Sachs co-chief of “sovereign risk” during the period 1998-2003, in which Goldman played the key role in taking down Long Term Capital Management and triggering a banking crisis from which Goldman profited. He then headed the Bank of Canada during the 2007-08 crash, where he is credited with being the first central bank bailer-outer of banks, and keeping Canadian big banks from failing in the crash. Then he was Bank of England Governor for eight years; head of the Financial Stability Board at the Bank for International Settlements; conference planner for the Davos events; and, last but not least, Sir Mike Bloomberg’s partner in running UN-based climate operations. Carney’s method, against corporations persisting in investing in fossil fuels, was “they will cease to exist,” as he stated publicly in a UN speech.